From ‘2’ to ‘3’ in 13 years and 5 months after exceeding the 2000 index

Material photo” alt=”The lobby on the 1st floor of the new building of Korea Exchange in Yeouido, Seoul. <한겨레> Material photo” />

Material photo” alt=”The lobby on the 1st floor of the new building of Korea Exchange in Yeouido, Seoul. <한겨레> Material photo” />

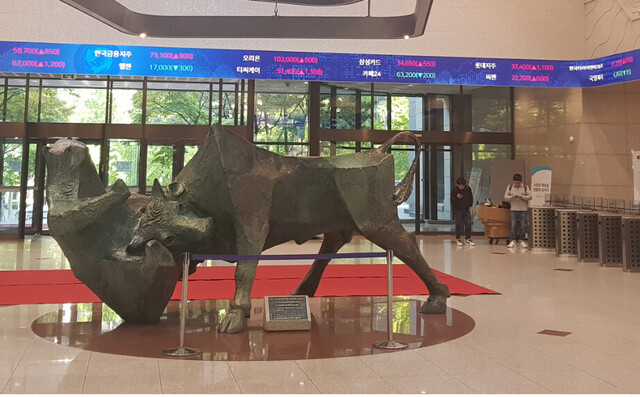

The lobby on the 1st floor of the new building of the Korea Exchange in Yeouido, Seoul. Base photo

The KOSPI index, the comprehensive stock price of the securities market (KOSPI market) representing the domestic stock market, exceeded the 3000 line for the first time on the morning of the 6th. On this morning, the KOSPI index was 3002.26, up 11.69 (0.39%) from the previous day immediately after the market started. It is the first time in the history of the domestic stock market that the KOSPI exceeded the 3000 line at one time during the market, and it was a record set in 13 years and 5 months after it first crossed the 2000 line in July 2007. On July 24, 2007, the KOSPI rose to 2005.02 during the intraday, crossing the 2000 line for the first time, then the closing price fell below the 2000 level, and the next day, the closing price on the 25th (22. 2004), broke the 2000 line for the first time. After the first crossing of the 1000 line on March 31, 1989 (1003.31), it took about 18 years and 4 months for the KOSPI to first cross the 2000 line. After breaking through the 2000 line, the KOSPI index was a tedious step. In October 2008, after a year or so, it fell to 938.75 (October 24, 2008) due to the global financial crisis. Even after it climbed to the 2000 line in December 2010, it remained in the 1800-2020 range for more than 5 years and was ridiculed as’boxpi’ and’gadori farm’. In 2017, thanks to the booming global semiconductor industry, it crossed the 2500 line on October 30 (2501.93), but fell into a recession again in the aftermath of the US President Donald Trump’s protectionism and the US-China trade war. From 2010 to 2020, it fell below 2000 without skipping and set a record for breaking through again. Last year alone, he was hit by the Corona 19 incident and collapsed until 1457.64 (March 19). It was the individual investors who caused the’Donghak ant’ craze that largely reversed the atmosphere of the downturn. A large number of individuals who saw the corona crisis as an opportunity due to the learning effect of the financial crisis or the foreign exchange crisis jumped into the stock market and built a sharp decline. Governments around the world have implemented aggressive economic stimulus policies, which are also considered to be the main drivers of the stock market. The KOSPI rose 30.8% last year, ranking first among the representative stock indices of 20 major countries (G20). Domestic securities companies have released data predicting the’KOSPI 3000 era’ one after another since last December. This is an optimism following the mainstream prospect that the domestic and international economy will improve in 2021. There is also high hope that the recovery of the global manufacturing economy will lead to strong domestic exports. It adds to this analysis that the dynamics of the share price increase have diversified due to the strong performance of new growth industries centering on the two major axes of the domestic industry, semiconductors and automobiles, as well as rechargeable batteries, biopharmaceuticals, internet, and games. International investment banks such as Goldman Sachs and JP Morgan are also optimistic about both developed and emerging markets. In the process of implementing policies to overcome the coronavirus, liquidity in the market is greatly increasing, and that there is no suitable management facility in the situation of ultra-low interest rates, it is considered as the fundamental basis of stock market optimism. However, the fact that the stock market rose so quickly is considered a burden. As of the end of last year, the market cap of the stock market is estimated to exceed 100% of gross domestic product (GDP) for the first time in history, and KOSPI’s share price-to-earning ratio (12-month forward PER) has risen to a record high of 13x. Inflation and rising interest rate pressures also remain risk factors. In a situation where the debt-to-equity ratio of corporations and households is high, if the market interest rate rises, it could act as a negative factor in the stock market. This means that even if the stock market is on the rise, it can be a’uneven road’. Kim Yong-gu, a researcher at Samsung Securities who raised the KOSPI forecast to 3300 this year, said, “The key is whether the’Donghak Ant Movement’ is becoming a mid- to long-term trend.” In view of the further reinforcement of risk preference and sentiment, the current trend was interpreted as “irreversible change, not an instant counterattack.” As risk factors that threaten this, Researcher Kim cited restrictions on the recovery of the real economy, latent political uncertainty, and weakened control over coronavirus quarantine. By Kim Young-bae, staff reporter [email protected]