Credit loan balance of 21 trillion won… not much different from the highest amount ever

Large-scale inflow of funds to the public offering stock subscription

Financial instability leads to… BOK “concerns about inflation expansion”

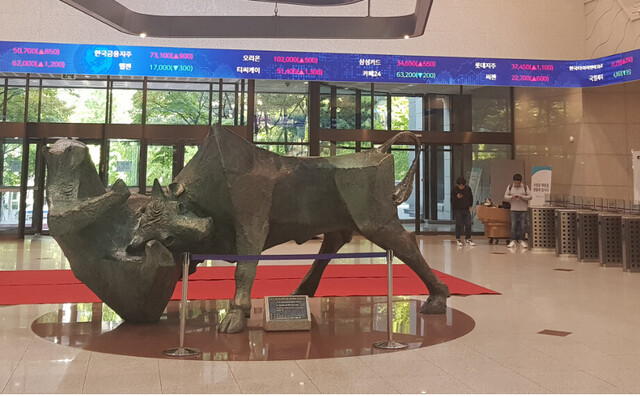

material photo” alt=”The lobby on the 1st floor of the office building of the Korea Exchange in Yeouido, Seoul.

material photo” alt=”The lobby on the 1st floor of the office building of the Korea Exchange in Yeouido, Seoul. The lobby on the 1st floor of the office building of the Korea Exchange in Yeouido, Seoul. <한겨레> Base photo

Despite the instability in the financial market due to rising interest rates and inflation, the trade of funds on the market is heading towards the stock market. According to the statistics of the Financial Investment Association on the 14th, the credit balance, which is money borrowed from securities companies by individual investors to buy stocks, reached 21,3476 billion won as of the 11th. Compared to the all-time high of 22,223.3 billion won on February 19, it decreased by 900 billion won, but considering the situation in the midst of rising interest rates and inflation, it seems to be the same level. The 10-year Treasury Bond yield (final offer rate) rose from the high 1.8% range on February 19th to the early 2% range on the 11th of this month. Investor deposits fell to the bottom of 60 trillion won on the 11th (57,6372 billion won) after peaking on January 12th (74,455.9 billion won). However, this is interpreted as a short-term movement inside the stock market, as large amounts of funds were concentrated in the offering of public offerings by companies scheduled to be listed, including SK Bioscience. The highest level of subscription margin of 63,619.8 billion won was poured into SK Bioscience’s public offering stocks on the 9th-10th. Unexpected margin was collected. Hwang Se-woon, a research fellow at the Capital Market Research Institute, predicted, “The interest rate has risen, but the short-term interest rate has not moved much, so it is unlikely that the flow from the banking sector to the capital market will change, and the trend leading to the stock market will continue.” According to the statistics of the Korea Exchange, individual investors net sold for two consecutive days in the KOSPI market on the 11th and 12th, but they have a buying advantage (1,682.6 billion won) in March as a whole. Individuals net bought 22,3384 billion won and 8,4381 billion won respectively in January and February in the KOSPI market. The KOSPI index fell below the 3000 line on the 8th (2996.11) and recovered to 3054.39 on the 12th. Despite this, interest rate uncertainty remains. On the 12th, the 10-year Treasury Bond yield ended at 2.092%, up 6.5bp (1bp=0.01% points) from the previous trading day, reaching the highest in two years and three months since December 4, 2018 (2.102%). The 3-year product rose 4.4bp to 1.223%, and the 5-year product rose 7.1bp to 1.596%. Commissioner Hwang Se-woon said, “With the passage of the US economic stimulus package, the issuance of treasury bonds will inevitably increase, causing interest rates to become unstable again and inflation concerns will continue.” The Bank of Korea also diagnosed, “As the US is pushing for a large-scale additional stimulus plan, there are concerns about increasing inflation.” In its weekly publication’Overseas Economy Focus’, the BOK said, “Concerns about inflation have grown recently due to the recent promotion of large-scale stimulus measures and the adoption of the average inflation target system (AIT) of the Federal Reserve System. In the U.S., a fiscal stimulus plan (5th round) worth 900 billion dollars (4.3% of gross domestic product) was implemented at the end of last year, and an additional stimulus plan worth $1.9 trillion (9.1%) was confirmed by Congress on the 10th of this month. The BOK explained, “Expectations for inflation have sharply increased as economic recovery prospects and raw material price rises have been added to the spread of the Corona 19 vaccine.” Senior Reporter Kim Young-bae [email protected]