|

On the 10th, the Bank of Korea in the’March 2021 Monetary Credit Policy Report’ released every quarter, “As a result of comprehensively judging the export conditions and risk factors for each item, exports this year increased significantly compared to last year due to global economic recovery and semiconductor economy improvement It is expected to do it.”

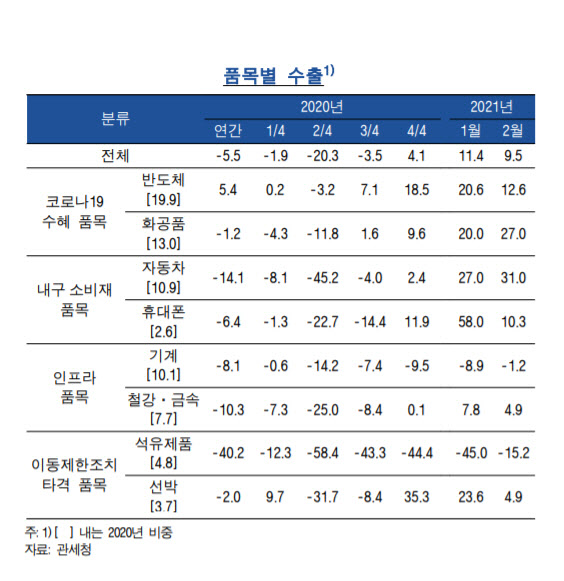

In the domestic economy, private consumption was sluggish due to the re-proliferation of Corona 19 and the strengthening of social distancing, but it has continued a gentle recovery trend centered on exports. It increased, centering on Korea’s flagship export items such as semiconductors, entered the upper path of’K-shaped recovery’ and led the recovery.

The outlook for this year is clear, such as semiconductors and automobiles that enjoyed corona 19 reflection profits

Export conditions were differentiated by item. Semiconductors and chemicals are the export items that benefited from last year’s Corona 19. Semiconductor exports have shown solid growth since the third quarter of last year due to increased demand for IT devices and online video (over-the-top) services due to the spread of remote work, education and digital leisure. IT device market size According to Gartner, a global technology research firm, the supply and demand rate of DRAM is expected to be 97.5% in the first quarter of this year and $3.2 per gigabyte (GB). This is similar to last year’s fourth quarter (100.5%, $3.2).

This year’s semiconductor exports are likely to slow down in non-face-to-face demand from 2H11 due to vaccine distribution, but are expected to be healthy thanks to the recovery of demand for servers from global IT companies and the growth of the 5G smartphone market. The proportion of 5G phones among all smartphone sales is expected to increase from 19% in 2020 to 37% in 2021.

As for chemicals, demand for chemicals has steadily increased since the second half of last year due to the strong sales of medical and hygiene products, pharmaceuticals, and diagnostic kits, and the use of packaging materials and disposable products for online shopping and delivery, increasing the proportion of exports from 13% last year to 27% last month. If the Corona 19 situation in major countries subsides due to the spread of vaccines after the second half of this year, demand for medicines and diagnostic kits will decrease, and there is a possibility that exports will be restricted.

Automobiles are also rapidly recovering from exports since the fourth quarter of last year on the back of the reflection effect of avoiding public transportation and the strong sales of SUVs in the US. This year, the global economic recovery and growing demand for electric vehicles are expected to serve as positive factors. LMC Automotive, a market research firm for the automotive industry, predicts that global automotive demand will increase by 10.9% year-on-year this year. For steel and machinery, export conditions are expected to improve on the back of demand recovery in downstream industries and infrastructure investment in major countries. For petroleum products, both demand and unit prices are expected to increase due to the ease of movement restrictions and the rise of international oil prices.

Vaccine supply gap and intensifying trade conflict between the US and China is an export risk

The delay in vaccine supply, the possibility of the emergence of mutant viruses, and the intensifying trade conflict between the US and China are expected to act as factors limiting exports to Korea.

The widening gap between developed and emerging countries in vaccine supply may prolong the virus transmission period and delay the time to achieve global collective immunity. If the global economy and trade recovery are limited, it could affect domestic exports as well.

Changes in the global trade environment come from both upside and downside factors. Following the inauguration of the Joe Biden administration, the government’s efforts to expand the FTA, such as the relief of uncertainties in US trade policy and the Regional Comprehensive Economic Partnership Agreement (RCEP), are expected to serve as factors to improve Korea’s export conditions. However, it should be noted that the US-China trade conflict, such as environmental and climate-related fields, intensifies.

In addition, the increase in international oil prices is expected to act as a factor for the increase in Korean exports, leading to higher export prices for petroleum products and chemicals. The BOK said, “In general, rising oil prices may limit the global economic recovery and have a negative impact on export volumes.However, the recent increase in oil prices appears to be mainly due to the recovery of demand for crude oil rather than supply factors such as production cuts. The negative impact is judged to be limited.”