[아시아경제 김효진 기자] Currently, the service for issuing virtual cards for overseas direct purchases, which are implemented by some card companies, will be expanded to all card companies from next month.

The Financial Supervisory Service announced on the 27th that such measures will be implemented to prevent damage to card information leakage by consumers related to overseas direct search.

When paying by card for domestic online transactions, the customer’s card information is encrypted, and affiliated stores such as online shopping malls cannot store the card information.

However, in the case of overseas online merchants, there are many cases where card information is directly stored and processed for payment without encryption.

In addition, it is pointed out that there is a high risk of information being stolen due to hacking, because most of the payments for overseas direct purchase only require entering the card number, expiration date, and CVC code.

Accordingly, the Financial Supervisory Service is planning to expand the service of issuing virtual cards for overseas direct purchases, which some card companies are implementing, to all card companies from January next year.

Issuance targets are consumers with affiliate cards issued by domestic card companies and international brand companies (VISA, Master, AMEX, UnionPayUPI, JCB, etc.).

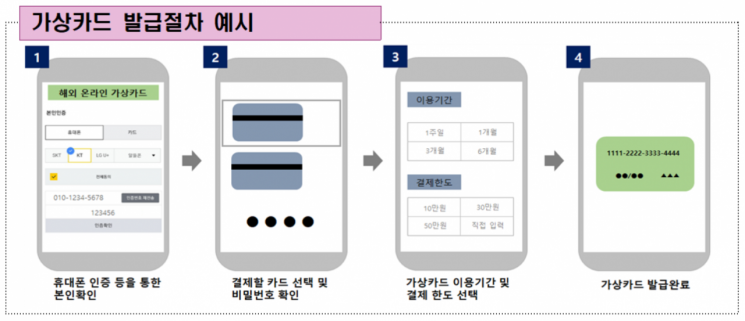

This is a way for the consumer to receive a virtual card through a card company application (app) and use it for a certain period of time.

Upon application, a virtual card with randomly generated card number, expiration date and CVC code will be issued.

The validity period can be selected from at least one week, and the number of payments can be selected according to the validity period. You can also set payment limits once or weekly or monthly.

According to the Financial Supervisory Service, the amount of overseas payments by domestic credit card members from 16,342.3 billion won in 2018 (total of online and offline) increased to 17,172.8 billion won last year. Until last August this year, it was totaled at 6.42 trillion won.

Reporter Kim Hyo-jin [email protected]