Loss of 380 billion won last year even if premiums are increased

Non-life insurers induce termination without signing up

Shinmo, an office worker, recently did not receive a’renewal notice’ from the insurance company even though the auto insurance maturity was nearing. I tried calling the call center to extend the contract, but the connection was not working. Since he cannot drive without insurance, Shin eventually transferred his auto insurance to another insurance company.

An official in the insurance industry explained, “Because the chronic deficit of auto insurance is so serious, it is not active to retain existing subscribers.”

According to the Non-life Insurance Association on the 7th, the cumulative operating deficit of auto insurance from 2011 to 2020 recorded 7.40 trillion won. In 2019, the annual deficit reached 1.6 trillion won. Last year, insurance premiums were raised and traffic accidents decreased due to the Corona 19 incident, but lost 380 billion won.

This year, there are concerns that the deficit could increase again if the corona 19 situation calms down with vaccination and traffic returns to the previous level.

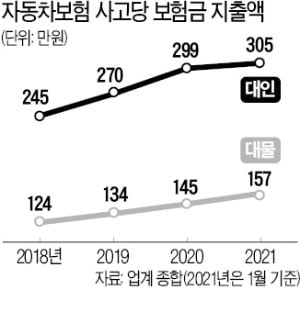

Insurance payments per accident are on the rise. Auto insurance premiums are under indirect price control by the government and cannot be raised at will.

Among the middle and low-ranking non-life insurers, cases of intentionally reducing auto insurance continue. Vehicles with a large amount of insurance, such as foreign cars, do not receive subscriptions or induce termination of contracts. A non-life insurer reduced its auto insurance market share from 5% to 3% in 5 years, reducing its operating loss by over 100 billion won.

Due to this influence, the share of Samsung Fire & Marine Insurance, Hyundai Marine & Marine Insurance, DB Insurance, and KB Insurance, which are the’big 4 in the non-life insurance industry’, is increasing. The auto insurance market share (based on premium income) of these four companies increased from 80.3% at the end of 2018 to 84.3% in the third quarter of last year. Top-tier companies also use a strategy of’picking a customer’ by offering lower prices than competitors to some models or age groups with low accident rates.

Reporter Lim Hyun-woo [email protected]

Ⓒ Hankyung.com prohibits unauthorized reproduction and redistribution