“I can’t believe the bond market, the Fed”… Global stock market’fall’ last week

On the 17th (local time), when the Fed ended FOMC in March, the 10-year US bond interest rate would have stabilized at the 1.6% level, and then surged again the next day, exceeding 1.7%. The interest rate ended at 1.732 on the 19th when news that the Fed would end its complementary leverage ratio (SLR) deregulation policy as scheduled. In just a week, it has passed 1.6% and settled at 1.7%.

A bond market official said, “Even if the Fed extended the SLR regulation, it is necessary to think about whether banks have bought bonds as much as they used to be.” “Because bond investors are diagnosed that the US economy is recovering faster than expected. “I don’t believe in the Fed’s position that inflation will not be that strong.”

The stock market was sensitive to interest rates every day. Overall declined on a weekly basis. Last week (15-19), the KOSPI fell 0.5%, the Shanghai Composite Index was 1.4%, and Taiwan’s 1.1%, a higher decline. On the other hand, the Hong Kong Hang Seng Index rose 1% and the Japanese Nikkei rose 0.2%, but the increase was not significant. In the case of the United States, the same trend was observed. Standard & Poor’s 500 (S&P500) and Nasdaq each fell 0.8%, and the Dow was 0.5%, which was a small drop.

|

Dowman uptrend… US economy-sensitive ETFs are strongWhat stands out is that Dow is the only global stock market on the rise. On the 18th, it reached a record high of 33227.78 during the intraday. On the other hand, the Nasdaq is on a downtrend after recording an all-time high of 14,175.12 on February 16th. This can be interpreted as a result of which markets each account for more weight in technology and growth stocks, which are sensitive to interest rates, and economically sensitive stocks, which are relatively less sensitive. It was on February 10 that the 10-year U.S. bond yield started at the 1.1% level and then rose steeply. This coincides with the period when the growth-oriented NASDAQ, which has many technologically innovative companies, peaked and fell.

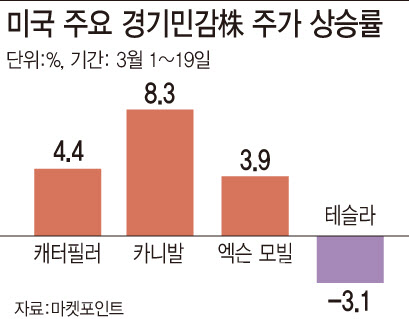

By category, the strength of the economy-sensitive sector is more pronounced. Heavy equipment manufacturer Caterpillar (CAT) rose 4.4% until the 19th this month. During the same period, energy company ExxonMobil (XOM) rose 3.9%, and cruise company Carnival (CCL) rose 8.3%. On the other hand, Tesla (TSLA), a symbol of technologyism, fell 3.1%.

The same is true of exchange-traded funds (ETFs). The Materials Select Sector SPDR (XLB), a collection of the basic materials industry among State Street’s SPDR brands, and the Industrial Select Sector SPDR Fund (XLI) of the infrastructure industry, rose 6.1% and 6.5%, respectively. SPDR Portfolio S&P 500 Growth (SPYG), a collection of growth stocks, remained in the consolidation range with a 0.4% increase.

“Emerging countries opportunity, may come early next year”

Experts predict that the US will continue to strengthen the global stock market, and the economic sensitization will continue to rise in the future. Only the US economy-sensitive stocks have a solo system. There are also observations that it will continue throughout the year for a long time.

First of all, the biggest cause is that the market’s interest has shifted from last year’s’corona 19 infected people’ to this year’s’vaccine vaccination rate’. Last year, keywords such as clean country and K-quarantine were highlighted, and markets in emerging Asian countries including China and Korea showed strong strength, but this year, the market of developed countries, which secured vaccines first, is turning to the right.

This also has a ripple effect in terms of the base effect. It is said that the K-Defense’s KOSPI rose too much last year, and the US stock market, which was relatively suffering from corona, each has a different space to increase. Regarding earnings, Korea’s exports improved since the second quarter of last year, but the US recovery was slower. Compared to the same period of the previous year, the corona base effect in Korea will end in the first half, but the US could continue.

In addition, when the dollar is strong, emerging countries have no choice but to take measures to appreciate their currency to defend the exchange rate. Last week, Russia, Turkey and Brazil raised their benchmark interest rates.

“President Joe Biden declared the Independence Day on July 4th as the completion date for collective immunization, and it is the only one in the world and is the core of the stock market situation.” “Because we know whether it will be steep, we are on the lookout for long-term stocks, and it may be a matter of time to exceed 2% (the 10-year US bond rate).

Heo Jae-hwan, head of the investment strategy team at Eugene Investment & Securities, said, “Now I have no choice but to rely on the US economy-sensitive sector. “If the current account deficit expands to the point where it loses and can buy Mexican goods beyond domestic demand, opportunities will come to emerging countries, but it seems that it will not be until the end of this year or early next year.”