Savings bank deposits (also known as parking passbooks), which pay around 2.0% per year even if left alone, are gaining popularity as the 2030 generation’s “real ammunition warehouse for investment”. It is said that young people who do’danta’ are in the spotlight as a purpose of leaving money for a while because they can earn more than three times the interest rate than ordinary bank deposits or securities company comprehensive asset management accounts (CMA). In the past year, about 3 trillion won was inflow into the parking account.

Parking passbook deposits tripled in a year

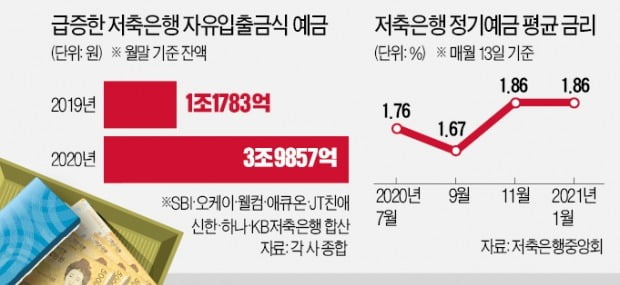

According to the industry on the 13th, the balance of the parking passbooks (normal deposits, savings deposits, business deposits) of major savings banks in Seoul (SBI, OK, Welcome, Accuon, JT Dear, Shinhan, Hana, KB Savings Bank) was 3 To 985.7 trillion won, it surged 2.8074 trillion won from the end of last year (1,1783 trillion won). A parking passbook can receive contract interest regardless of the amount or period of deposit or the number of deposits and withdrawals. Savings deposits that can only be subscribed to by individuals, corporate free deposits, and ordinary deposits that can only be paid by self-employed people are called parking accounts.

An official from a savings bank said, “Even into the new year, the inflow of funds to the parking passbook continues mainly for young people in their twenties and forties.” “In recent two months, the balance of the parking passbook has risen from 600 billion won to more than 800 billion won.” An industry insider explained, “Savings banks, which have a high proportion of deposits with frequent deposits and withdrawals, are usually 15% of all deposits, but some of them have recently exceeded 20%.”

The inflow of funds from 2030 households is remarkable. The percentage of subscribers by age group of Welcome Office Workers’ Love Common Deposit (2.0% per year) is half (47.4%) in their 30s. 40s (28.0%) and 20s (12.7%) followed. As for the “Welcomm President Love Normal Deposit”, a deposit product for individual businesses, the proportion of customers in their 40s was the highest at 38.0%, but the inflow of 30s (26.2%) also stood out.

An official of Welcome Savings Bank said, “In the savings banking industry where the percentage of middle-aged people is high, it is unusual for the young people to increase their free deposit and withdrawal deposit balance. Analyzed. Savings bank parking passbook deposit rates range from 1.5% to 2.0% per year. It is much higher than the 1.0% annual CMA interest rate for securities companies, which is drawing attention among stock investors.

Parking passbook deposit rate seems to go down

Savings banks are lowering the receiving rate as a lot of money is crowded in the parking account. This is because the interest rate burden increased as deposits increased significantly. An official of a savings bank said, “Some savings banks maintain the interest rate of free deposit and withdrawal products higher than the periodic deposit rate, where deposits and withdrawals are restricted to secure platform customers. I predicted.

On the 7th, Pepper Savings Bank slightly reduced the interest rate of the Peppero Savings Deposit, a free deposit and withdrawal deposit, from 1.7% per annum to 1.6%. SBI Savings Bank, OK Savings Bank, and JT Savings Bank also lowered the interest rate for non-face-to-face ordinary deposits from 2.0% a year to 1.3% a year. The Welcome Savings Bank also lowered the annual interest rate of 2.5% of the annual Welcome Office Workers Love Common Deposit to 2.0%.

On the other hand, interest rates for time deposits are rising. This is to prevent middle-aged people’s funds from churning out for stock investments, etc. According to the Federation of Savings Banks, the average deposit rate of 79 savings banks fell to 1.6% per year in September last year, and rose to 1.91% per year in December last year. As of the 13th, it is maintained at 1.86% per year. OK Savings Bank also raised the OKShot Term Deposit Rate from 1.5% to 1.8% a year and launched special products with a limit of 100 billion won.

Reporter Park Jin-woo [email protected]

Ⓒ Hankyung.com prohibits unauthorized reproduction and redistribution