Concealment after non-payment of income tax, transfer tax, inheritance tax, gift tax, etc.

Due to the revision of related laws, there is an obligation to report large amount of cash transactions on the exchange.

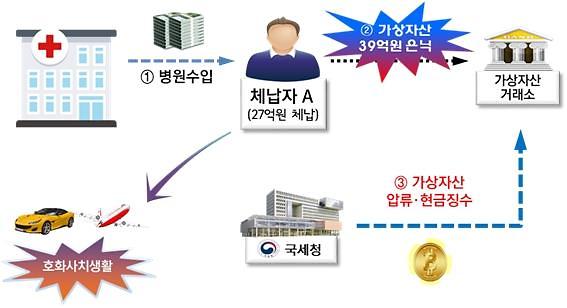

A case of high-income professionals who concealed hospital business income as virtual assets. [국세청 제공]

The National Tax Service announced on the 15th that it had enforced a compulsory collection of 2,146 high-payers who concealed their assets with additional assets such as bitcoin.

The National Tax Service secured 33.6 billion won in cash and bonds by collecting and analyzing’virtual asset holding status data’ of arrears from virtual currency exchanges. In addition, 222 of them are conducting a follow-up investigation after being suspected of concealing other assets other than virtual currency.

Assets donated without paying 2.6 billion won in arrears arising from underreporting the property donated from related persons or concealing the transfer proceeds in virtual currency without paying 1.2 billion won in capital gains after transferring real estate equivalent to 4.8 billion won among delinquents There were cases of concealing and confiscation with cryptocurrency.

Earlier, the Supreme Court ruled in May 2018 that virtual assets were subject to confiscation, as’intangible assets with property value’. After the Supreme Court’s ruling, each district court issued a ruling that recognized the claims for withdrawal of virtual assets, claims for performance, and claims for return as the subject of seizure. This is the first time a government department has enforced collection of virtual assets after the Supreme Court ruling.

When concerns about money laundering and tax evasion using virtual currency arose, the government implemented the international standards of the International Anti-Money Laundering Organization (FATF) and began to amend the law to prevent crime by regulating money laundering using virtual assets. Accordingly, as the’Act on Reporting and Use of Specific Financial Transaction Information, etc.’ is amended, virtual asset business operators must report large amounts of cash transactions in the case of transactions suspected of illegal property like existing financial companies.

The National Tax Service expected that the effectiveness of forced collection could further increase as the price of virtual assets such as bitcoin surged recently.

The number of cryptocurrency investors will increase from 1.2 million in 2020 to 1.59 million in 2021. The average daily transaction amount also surged from 1 trillion won in 2020 to 8 trillion won in 2021. Bitcoin, a representative cryptocurrency, is on the rise, with the price per bitcoin surpassing 70 million won.

“The National Tax Service is working on a variety of collection measures, such as promoting new planning and analysis on increasingly intelligent property concealment activities and expanding the collection of data from external organizations,” said Jung Cheol-woo, director of the Taxation and Legal Affairs Bureau at the National Tax Service. “We will quickly respond to the concealment method and track and recover the hidden property of the high-liquid delinquent.”

Chung Cheol-woo, head of the Taxation and Legal Affairs Bureau of the National Tax Service, is giving a briefing on the forced collection of virtual assets of large-amount payments on the 15th. [사진=국세청 제공]

©’Five-language global economic newspaper’ Ajou Economics. Prohibition of unauthorized reproduction and redistribution