The Korea Insurance Development Institute explained that if a person in their 40s to 50s with children retires someday, they will need 170 million won per child.

Children at retirement 22% Unemployed 35% Single

Education expenses 6989 million won and marriage expenses 100 million won

Average assets 400 million units, severance pay 9466 million won

Those in their 40s and 50s own a large portion of their assets as real estate, so they may have difficulty in obtaining cash after retirement, the Korea Insurance Development Institute analyzed.

On the 11th, the Korea Insurance Development Institute published the ‘2020 KIDI Retirement Market Report’ containing these details. The report contained the results of a survey conducted on 700 people in their 30s to 50s nationwide in 2019. Two out of three survey participants (62.6%) said they would feel the burden of supporting their children someday after retirement. Compared to the same survey conducted in 2017, the response rate increased by 6 percentage points.

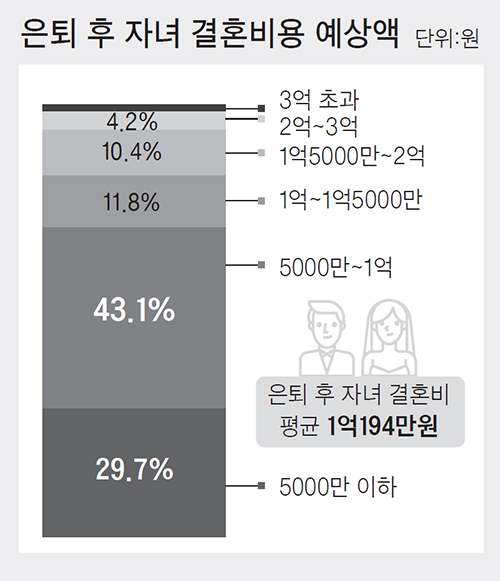

Estimated amount of child marriage expenses after retirement

They estimate that even after retirement, they need an average of 6989 million won per person for their children’s education and 11.94 million won per person for their children’s marriage expenses. The more children there are, the more money will be spent on them after retirement. According to the National Pension Service’s retirement security panel survey, at the time of retirement, 22% of children were unemployed and 35% were single.

Composition of 4050 households real assets

The expected income after retirement by the respondents to the Korea Insurance Development Institute survey was 68.5% of the income before retirement. The appropriate living expenses (based on couples) that they see was 3.12 million won per month, and the minimum living expenses were 2.27 million won. Their expected income after retirement was about half of their pre-retirement income (50.4%). According to the National Statistical Office, the average annual income of retired households was 27.87 million won, which was 58% of the income of those who did not (62.55 million won).

The average retirement benefit (severance pay) expected for those in their 40s and 50s was 9466 million won. Of these, 40.1% answered that the expected severance pay is less than 50 million won.

Composition of 4050 households financial assets

According to the 2019 Household Financial Welfare Survey by the National Statistical Office, the average asset in their 40s was 4,6967 million won, and that of 50s was 493.45 million won. More than 70% of all assets were real assets such as real estate. The proportion of real assets in their 40s accounted for 72.4% (3,3994 million won), and the proportion of real assets in their 50s accounted for 74.4% (36.7 billion won). Among real assets, residential housing was more than half of those in their 40s (57.5%) and 50s (52.7%).

The ratio of public pensions as a preparation for retirement was more than half of both men (72.9%) and women (59.2%). In 2019, the replacement rate for recipients of the national pension (old-age pension) was 21.3%. If the average lifetime income of an annual recipient is 1 million won, it means that the money received from the national pension is only 213,000 won.

Reporter Ahn Hyo-seong [email protected]