Accordingly, we maintained the investment opinion of the company’s stock at’Buy’ and the target price at KRW 220,000. LG Electronics’ current share price is 154500 won per share (based on the 5th closing price).

In a report published on the 6th, Kyung-Tak Noh, researcher at Eugene Investment & Securities said, “The company’s sales will decrease in the short term due to LG Electronics’ decision to withdraw the mobile phone business (MC business), but it will have the effect of improving profit and loss and improving the financial structure of the mobile phone business. did.

|

LG Electronics announced on the previous day that it will end its mobile phone business at the end of July due to intensifying competition in the mobile phone business and continued sluggish business. It also said that it would promote improvement of the company business portfolio through selection and concentration.

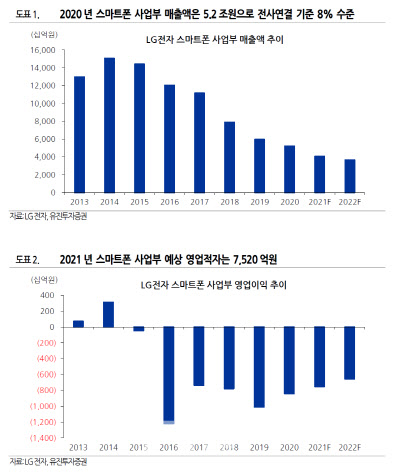

Last year, LG Electronics’ mobile phone business recorded a sales of 5.2 trillion won and an operating deficit of 8412 billion won. Initially, Eugene Investment & Securities predicted that this year’s operating deficit would also record 755 billion won.

Researcher Roh said, “With the end of production and sales in the mobile phone business, the operating deficit, which had been a large part of the business, will be resolved.” “Investment in home appliances and electronic components with global competitiveness, and B2B (business targeting businesses), etc., is expected to expand.” I looked out. He said, “In particular, diversification of customers and earnings turnaround will be a mid- to long-term investment point due to the full-scale growth of the electronic equipment business, such as the establishment of LG Magna Joint Venture (JV) in July.”

“LG Electronics’ annual operating profit will improve by about 500 billion won when considering fixed costs such as relocation of manpower and continued investment in R&D to secure future technologies.” It is projected to be 4.29 trillion won and 4.77 trillion won next year.”

In the first quarter of this year, LG Electronics’ sales are estimated at 18,955 billion won and operating profit of 1.321.6 billion won, up 28.7% and 21.2% respectively compared to the same period last year. Researcher Roh said, “Good results are expected from the launch of new home appliances and TVs and the entry into the peak season, and product mix (mixing) is expected to improve due to increased demand for new home appliances such as steam appliances, hygiene, and health.” Despite this, it will exceed the previous estimates due to an increase in the portion of premiums such as organic light-emitting diode (OLED) TVs and large-sized UHD.”