Expectations of stimulus measures and impact of government bond volume burden

International oil prices and heavy producer inflation are also the cause

Interest in countermeasures such as the size of the BOK Treasury purchase

“Stock market burden when interest rates surge”

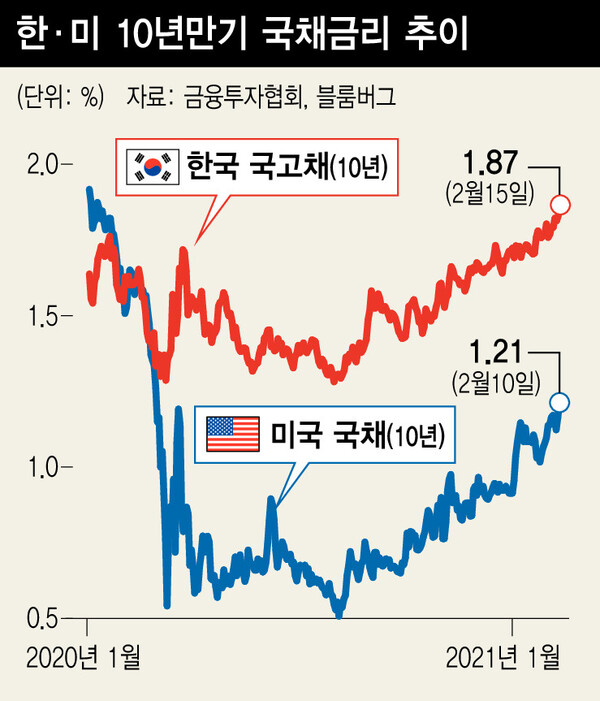

Treasury yields in Korea and the U.S. have risen, centered on long-term bonds, rising to the level before the outbreak of Corona 19. Both countries are analyzed to raise interest rates due to the expectation that the economic recovery will accelerate due to expanded fiscal policies and the burden of increasing government bond issuance for financing. In the Seoul bond market on the 15th, the 10-year Treasury bond maturity rate soared 0.04 percentage points to 1.871% per year, the highest in one year and nine months since May 13, 2019 (1.874%). The 30-year Treasury bond rate also recorded 2.012%, the highest in two years and two months since November 29, 2018 (2.014%). This is the first time since March 19, 2019 that the interest rate in 30 years has risen to 2%. The 10-year Treasury bond rate was 1.21% on the 12th, the highest level since March last year when the financial market was shocked by Corona 19. The US 30-year interest rate has risen to 2.01% for the first time since February last year. In general, short-term interest rates are in the sphere of influence of the base rate, but long-term interest rates move by reflecting the economy and inflation. The expectation that the economic growth will expand with US President Joe Biden’s $1.9 trillion stimulus plan is pushing the US long-term bond yield. Increasing the volume of government bonds for financing is also a factor in rising interest rates (falling government bond prices) in terms of supply and demand. ‘Expected inflation’ caused by rising international oil prices is also affecting the rise in interest rates. The market predicts the US inflation rate (BEI) over the next 10 years at 2.21% per year, the highest since 2014. Do-Hyun Kwon, deputy expert at the International Financial Center, analyzed, “The’average price target system’ of the Federal Reserve System (Fed), which states that interest rates will not increase even if the inflation rate exceeds 2% for a certain period of time, induces inflation.” China’s producer prices also emerged as a variable. China’s January Producer Price Index (PPI), released on the 10th, rose 0.3% from the same month last year, and turned upward in one year. Accordingly, it is diagnosed that China, the world’s factory, has created an environment for exporting inflation again. Park Sang-hyun, an expert committee member of Hi Investment & Securities, pointed out, “In terms of inflationary pressure in China being exported to the world, there is a greater room for impact on US consumer prices. It is analyzed that the increase in the interest rate of long-term domestic government bonds also has a large impact on the expansion of finances such as the 4th disaster support fund. Kang Seung-won, a researcher at NH Investment & Securities, said, “The growth contribution of government expenditures will increase due to the formation of an additional budget, and the growth rate in the first quarter is highly likely to be higher than expected, considering the recent strong exports.” The bond market remains unstable as the amount of extra budget and government bond issuance has not yet been revealed. Kim Ji-na, a researcher at IBK Investment & Securities, predicted, “If the outline of the supplement comes out before the Monetary Policy Meeting of the Financial Monetary Commission to be held on the 25th, we will be able to figure out the countermeasures such as the size of the BOK’s government bond purchases.” The gradual rise in interest rates reflecting the economic recovery is not negative for the stock market. The problem is a surge in interest rates accompanied by inflation. SK Securities researcher Hyo-Seok Lee predicted, “Even in February and November 2018, an increase in interest rates led to a decline in stock prices, so if the Treasury bond rate rises, it will be a burden on the stock market.” Senior Reporter Han Kwang-deok [email protected]