Joe Biden is the next President of the United States. / Source = Yonhap News

Key indices on the New York Stock Market declined even after the next US President Joe Biden released a stimulus package. Expectations of stimulus measures have already been reflected, and sluggish economic indicators such as retail sales have been released, holding back the stock market.

On the 15th (local time) on the New York Stock Exchange (NYSE), the Dow Jones 30 Industrial Average fell 177.26 points (0.57%) from the battlefield to 30,814.26. The Standard & Poor’s (S&P) 500 index fell 27.29 points (0.72%) from the battlefield to 3,768.25, while the technology stocks Nasdaq index fell 114.14 points (0.87%) to 12,998.50, respectively.

The Dow index fell by about 0.9% this week. The S&P500 Index and the Nasdaq each showed a stand-off of about 1.5%. Major indices this week reached all-time highs in anticipation of US President Joe Biden’s $1.9 trillion in stimulus package, but the week ended due to weakness.

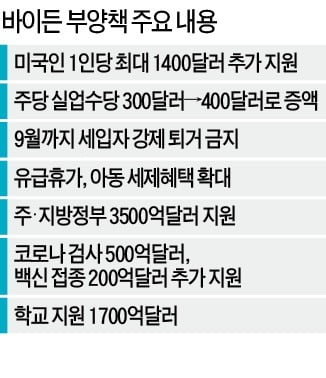

Biden-elect presented a stimulus package the day before, including additional cash payments to Americans, expansion of unemployment benefit subsidies and extension of the period. It announced that it plans to announce another fiscal stimulus next month that focuses on infrastructure investment and response to climate change. However, the index declined as it was evaluated that the stimulus expectations were significantly reflected in the stock market. Concerns over the tax burden have also been raised with massive fiscal stimulus measures that doubled the amount of $900 billion approved at the end of last month.

Major economic indicators in the US were also sluggish. The US Department of Commerce announced that December retail sales fell 0.7% from the previous month. It was far greater than the 0.1% decline in the market forecast compiled by the Wall Street Journal. The preliminary value of the Michigan Consumer Attitude Index for January was 79.2, down from the previous month’s final value of 80.7. It fell short of the market forecast of 79.4.

The decline in stock prices of major banks also pulled the stock market down. Citigroup shares plunged 6.9% on the day, while Wells Fargo fell 7.8%. Financial stocks fell 1.8%, with JPMorgan’s share price falling 1.8%. The energy sector also fell by more than 4% on the news that the US authorities are undertaking an investigation into the large oil company Exxon Mobil.

The volatility index (VIX) on the Chicago Options Exchange (CBOE), also called the fear index, was 24.34, up 4.69% from the previous trading day.

Hankyung.com reporter Kim Hana [email protected]

Ⓒ Hankyung.com prohibits unauthorized reproduction and redistribution