The financial authorities decided to conduct a joint black-and-white check on the stock reading room, which pays high-priced advisory fees to individual investors as a bait for high returns. The main target of crackdown is the act of providing one-on-one counseling, etc. for receiving a high subscription fee.

The Financial Services Commission announced on the 28th that it had held a joint meeting with the Financial Supervisory Service and the Korea Exchange on the 26th to discuss countermeasures against illegal and unfair public financial crimes. The main content is to extend the intensive response period until the end of June and strengthen the crackdown and punishment for stock reading rooms, voice phishing, and similar receptions.

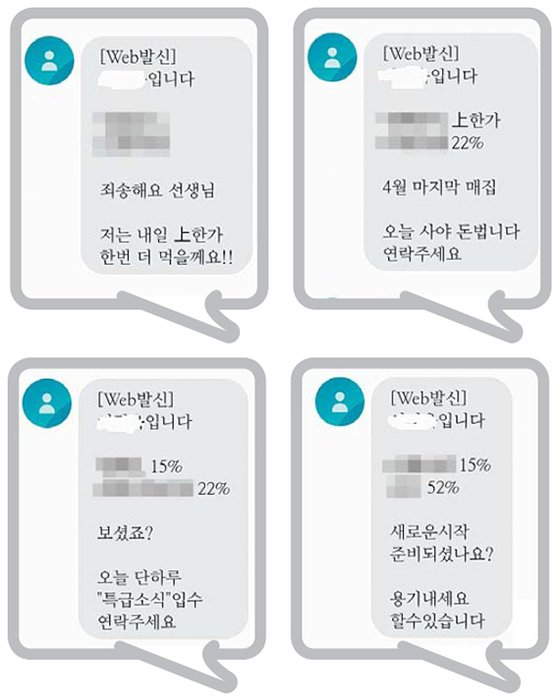

Letters inviting you to join the stock reading room. Central DB

The financial authorities form a joint investigation into the stock reading room and a research team dedicated to various theme stocks. The stock reading room is operated by receiving advisory fees from members and then guiding the trading item and timing through Kakao Talk or text messages. Stock items are recommended for free through open chat rooms, spam messages, YouTube broadcasts, etc. to an unspecified number of people, and a method of inviting them to a private chat room when signing up for a paid member is used.

The target of the black-and-white check is for unregistered investment advisory businesses such as one-on-one counseling, or discretionary investment business such as’copy training’ in which investors can trade in the same way according to the transaction details of a specific trainer. Stock reading room operators are unverified similar investment advisors or ordinary individuals, but they cannot provide one-on-one advice.

The financial authorities will expand the subject of penalties for stock reading rooms to quickly recover unfair gains, and promote a method to legislate the method of calculating unfair gains. An official from the financial authorities said, “As it is not easy to prove unfair trade, if it is caught, we will strictly sanction it at the level of a worker punishment so that it will not be able to step into the market again.”

According to the Korea Consumer Agency and the Korea Consumer Organizations Association on the 7th, the number of damage consultations related to stock reading rooms (investment advisory) received at 1372 Consumer Counseling Center, a nationwide consumer counseling integrated call center. yunhap news

The Financial Services Commission also distributed major notes on stock reading rooms. What the Financial Services Commission has requested is that stock reading rooms are operated by companies whose expertise has not been verified, so do not be fooled by false or exaggerated advertisements, and even if you make a contract, you should carefully check the contract. If you want to cancel the contract, it is often returned after deducting a large amount in the name of textbooks or program fees.

The Financial Services Commission also said, “Even if you simply follow the operator’s trading orders, you may be involved in a stock price manipulation crime, leading to prosecution investigations and criminal trials.”

Response directions and tasks for public welfare crimes announced by the Financial Services Commission on the 28th. Financial Committee

Voice phishing decided to conduct extensive investigations on new crimes such as messenger phishing, and provide customized quick damage relief. It is also pushing ahead with measures for financial companies to bear certain liability for compensation beyond damage relief cooperation. However, there is also a backlash that it is excessive to make financial companies liable for compensation for voice phishing.

The level of punishment for similar receipts will be increased from’imprisonment for not more than 5 years or a fine of not more than 50 million won’ to’imprisonment for not more than 10 years or a fine of not more than 100 million won’, and the law will be revised to enable confiscation and collection of criminal profits. . The subject of punishment was also to be extended to the act of impersonating institutional financial products and guaranteeing the rate of return through investment in financial products. It is also considering a plan to establish a new investigative power for the financial authorities. Similar reception refers to the case of raising funds from a large number of unspecified persons without obtaining approval or permission as a bait for high profits.

Reporter Ahn Hyo-seong [email protected]

![]()