The global DRAM market is entering the phase of’super cycle (long-term boom)’. DRAM prices are rising sharply as supply cannot keep up with demand, and semiconductor exports are on the rise despite the off-season. Semiconductor companies are also making trillions of facility investments in anticipation of improving the mid- to long-term industry conditions. There is also a forecast that the rate of increase in fixed transaction prices in the second quarter will reach 15%.

According to the Korea Customs Service on the 25th, the export of memory semiconductors on the 1st to 20th of this month was $1,073 million, an increase of 14.9% over the same period last month. Exports of DRAM-centered package semiconductors (MCPs) for smartphones increased 16.6%.

In the industry, it is said that it is unusual for exports to show a double-digit growth rate in February, a traditionally low season for information technology (IT) products.

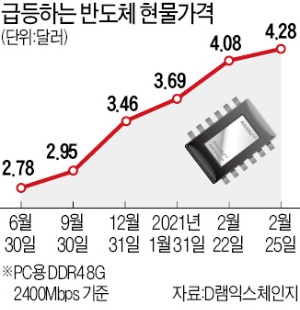

The DRAM spot market, which reflects the semiconductor industry in real time, has turned to a clear’supplier advantage’. The spot price of DDR4 8G 2400Mbps, a general-purpose PC DRAM product, exceeded 4 dollars in 22 months on the 22nd. The price as of the 25th was 4.28 dollars each, up 16.1% from the end of last month and 23.6% from the end of last year.

An industry official said, “The buyers are stockpiling, but the supplier’s willingness to sell is weak,” and said, “A typical’shortage’ situation.”

Recently, demand for semiconductors is increasing in all directions. In the server DRAM market,’big hands’ such as Google and Amazon have recently resumed server investments at once. As Chinese smartphone makers aggressively launch products to expand their market share, demand for DRAM is on the rise, and PC DRAM purchases are also steadily flowing due to the increase in telecommuting.

This market atmosphere is expected to be reflected in the fixed transaction price, which shows the market price of mass transactions between companies. Market research firm TrendForce raised its forecast for the 2Q12 fixed transaction price increase rate from 8 to 13% to 10 to 15%.

On the 24th, SK Hynix signed a contract to introduce extreme ultraviolet (EUV) exposure equipment worth 4.4 trillion won. The market is taking it as a sign that the semiconductor boom will continue.

Reporter Hwang Jeong-soo [email protected]

Ⓒ Hankyung.com prohibits unauthorized reproduction and redistribution