Woori Technology Investment and Hanwha Investment & Securities’ equity value highlighting

(Data provided = Research information)

With the outbreak of the cryptocurrency craze, Dunamu’s corporate value is also being reevaluated. Doonamu operates’Upbit’, which records the largest cryptocurrency transaction volume in Korea. As the market cap of Coinbase, the number one coin exchange in the US, reached 100 trillion won in recent years, expectation for IPO (public disclosure) of Dunamu is growing.

‘Upbit’ is running strong as it occupies more than 70% of the domestic cryptocurrency transaction value. According to Research Rum on the 16th, the total daily transaction amount of domestic virtual currency was 16,694.7 billion won, which exceeds the average daily transaction value of KOSPI (16 trillion won) and KOSDAQ (11 trillion won). Doonamu operates an unlisted stock trading platform’Securities Plus Unlisted’ and a virtual asset exchange’Upbit’.

In recent years, expectations for an IPO of Dounamu are growing. Coinbase, the number one coin exchange in the US, is about to go public in March this year. It is also observed that if Coinbase proves the value of 100 trillion won in market capitalization,’Upbit’, which currently exceeds Coinbase’s transaction amount, can also be re-evaluated with a value of at least 1/10.

The industry estimates it at 5 trillion won. Researchalum said, “The company’s corporate value, which was assessed by the sale of old shares in October last year, was about 700 billion won.” Considering that it is a commission based on the transaction price, the estimate of the enterprise value of KRW 5 trillion is reasonable,” he judged.

In addition, there is an analysis that if two trees do an IPO, there is a high possibility of going to the United States. This is because the listing requirements are less demanding than the KOSPI or KOSDAQ, and it is easier to raise capital than the Korean stock market. The Korean stock market’s share price/earnings ratio (PER) is about 15x, but the US stock market is 25x. The reason is that there is a high possibility of receiving a high valuation.

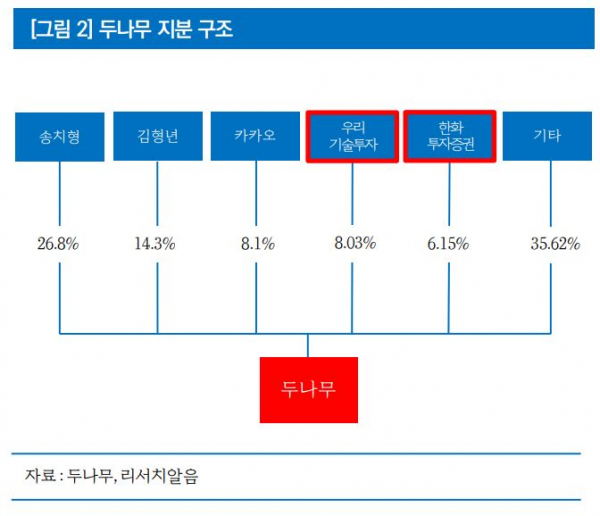

Meanwhile, securities companies advised to pay attention to Woori Technology Investment and Hanwha Investment & Securities as beneficiaries of the Doonamu IPO. This is due to the expectation that the value of the stake will be highlighted as a major listed company that owns a stake in Doonamu.

Woori Technology Investment has steadily purchased after acquiring a 4% stake in the company for 500 million won in February 2015, and has acquired an 8.03% stake for a total of 5.6 billion won. In February of this year, Hanwha Investment & Securities acquired a 6.15% stake in Dunamu, which was owned by Qualcomm, for KRW 58.3 billion based on a valuation of about KRW 1 trillion.

ResearchAlum added, “If Dunamu succeeds in listing on the US stock market and receives a valuation of about 10 trillion won, the equity values of the two listed companies will be 800 billion won and 600 billion won, respectively.”