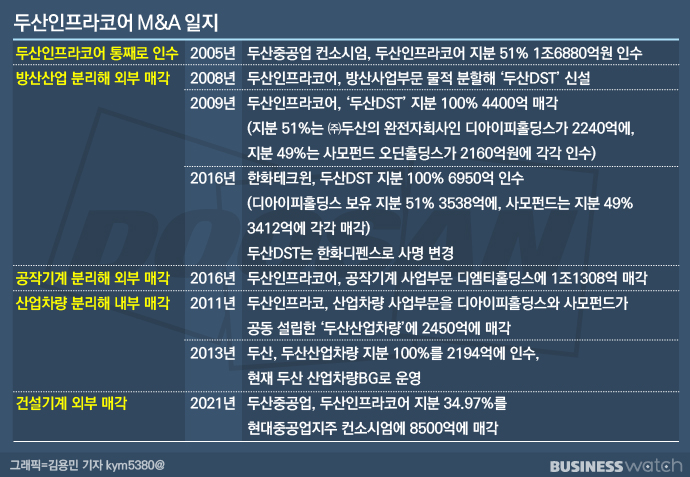

Doosan Heavy Industries & Construction signed a main contract to sell Doosan Infracore to a consortium of Hyundai Heavy Industries Holdings. It has been 16 years since Doosan Heavy Industries & Construction took over the old Daewoo General Machinery and changed its name to Doosan Infracore in 2005.

During this period, it is analyzed that the Doosan Group maximized the profits of M&A trading by separating and selling several business groups of Doosan Infracore. It is a method of buying whole and cutting it into small pieces. The remaining schedule is the separation of Doosan Bobcat shares from Doosan Infracore.

◇’The standard of separate sale’

Recently, Doosan Heavy Industries & Construction decided to sell its 34.97% stake in Doosan Infracore for 850 billion won. Although it did not receive the 1 trillion won ransom price discussed in the initial negotiations, it seems that a compromise has been found considering Doosan Infracore’s market cap (1,898 trillion won based on the closing price on the 8th). The market value of the stake (34.97%) that was sold this time is around 663.7 billion won, which means that it has not received more than 200 billion won in management premium. Moreover, considering that Doosan Bobcat, which owns a 51.05% stake by Doosan Infracore, was excluded from the sale, it is said to have received a reasonable price.

It is a business that remains even compared to the price that Doosan Heavy Industries & Construction acquired Doosan Infracore in 2005. At the time, the Doosan Heavy Industries & Construction consortium acquired a 51% stake in Daewoo General Machinery (currently Doosan Infracore), which had business groups such as machine tools, industrial vehicles, defense industries, and construction machinery for 1.68 trillion won. Since then, Doosan Group separated and sold Doosan Infracore’s machine tools and defense industry, but it is estimated that the initial purchase price has already been recovered from the separate sale price alone.

First of all, the Doosan Group sold a stake in Doosan DST (now Hanwha Defense), which was created by dividing Doosan Infracore’s defense industry, twice in 2009 and 2016. . Doosan Infracore’s machine tool division in 2016, which was caught in a financial crisis, also sold for KRW 1.13 trillion. Doosan Group secured a total of 1.7 trillion won by selling Doosan Infracore’s defense industry and machine tool divisions. This is equivalent to the price of the 2005 acquisition of Doosan Infracore.

In 2011, Doosan Infracore removed the industrial vehicle business and sold it for 245 billion won. After a hand change between affiliates within the group, this division remains as Doosan Corporation’s Industrial Vehicle BG. Even if Doosan Group sells Doosan Infracore, some still remain. In the end, Hyundai Heavy Industries Holdings removed machine tools, defense and industrial vehicles, and finally acquired Doosan Infracore’s construction machinery (excavator) and engine divisions for 850 billion won.

◇ Doosan Infracore’s financial deterioration when stakes in Doosan Bobcat are removed

The remaining schedule is to separate Doosan Bobcat from Doosan Infracore. Doosan Infracore owns a 51.05% stake in Doosan Bobcat, but Doosan Bobcat was excluded from the sale. In the industry, Doosan Infracore is expected to split into’Doosan Infracore Holdings’ (tentative name), which owns Doosan Bobcat shares, and’Doosan Infracore’, which is the target of sale. Doosan Infracore Holdings remains with Doosan Heavy Industries & Construction, and Doosan Infracore is handed over to Hyundai Heavy Industries Holdings.

On the 5th, Doosan Heavy Industries & Construction announced that it will sell all shares of Doosan Infracore to Hyundai Heavy Industries Holdings after separating some assets, liabilities, manpower, and contract relationships that are not directly related to the business currently operated by Doosan Infracore. This means that Doosan Infracore will carry out a Carve-Out, which is the valuation of Doosan Bobcat shares.

In the process of selling Doosan Engine (now HSD Engine) by Doosan Heavy Industries & Construction in 2018, the Carveout strategy was applied. At that time, Doosan Heavy Industries & Construction sold Doosan Engine to the Sociers Wel-to-Sea Consortium, dividing Doosan Engine’s 10.55% stake in Doosan Bobcat into the investment sector and merging the investment sector with Doosan Heavy Industries & Construction. Doosan Engine was sold and Doosan Bobcat shares were left behind.

It is analyzed that the financial situation of Doosan Infracore will deteriorate if Doosan Bobcat shares are released. This is because Doosan Bobcat, which is at the forefront of the North American small machinery market, has widened the gap. As of 2019, Doosan Bobcat accounted for 55% of Doosan Infracore’s consolidated sales. On a separate basis, Doosan Infracore’s stake in Doosan Bobcat is worth KRW 1.521.5 trillion, which was used as a source of finance to reinforce Doosan Infracore’s financial flexibility.

In fact, the debt ratio of Doosan Engine, in which Doosan Bobcat’s stake was separated during the sale, increased from 126.7% in 2017 to 221.8% in 2018. Recently, Korea Credit Rating analyzed that “if the Doosan Bobcat stake is excluded in the future, it will negatively affect Doosan Infracore’s business and financial aspects.”

When the settlement of Doosan Bobcat shares is completed, Hyundai Heavy Industries Holdings plans to complete the acquisition process within the third quarter of this year by requesting approval for a merger at home and abroad. Related Articles ☞ Hyundai Heavy Industries, Doosan Solves’The Last Puzzle’