129 domestic management companies participated… Hankyung Fund Manager Survey

Last year, the stock market was dominated by intuition and ferocity. Donghak ants, seeing an opportunity in the crash market, courageously rushed to the market. Bold bets returned to profit. From the corona beneficiaries to the economy-sensitive stocks, every sport that touches has magically risen. The stock price was 2873.47, a record high, ending the year to celebrate their success.

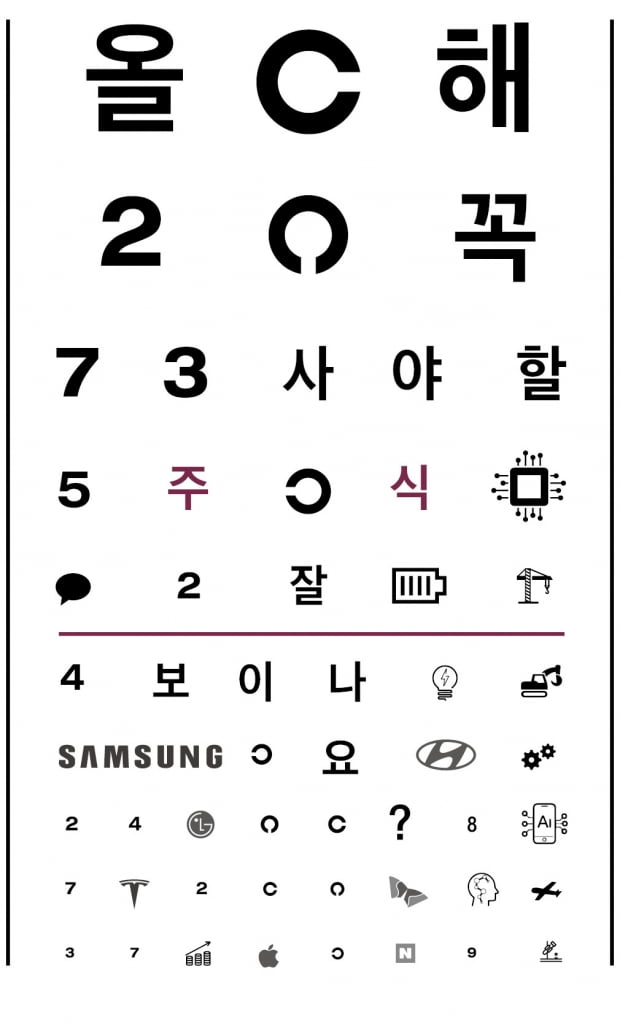

This year is different. A normalized market is the keyword. The market is over when you buy the right item by throwing a stone on the item display board. The time has come when reason and logic are needed instead of intuition and wildness. The Korea Economic Daily has prepared a stock investment guidebook for 2021 with the help of 129 fund managers from renowned investors, fund managers and analysts at the securities firm’s research center. From the attitude of dealing with stocks and how to open an account, the market forecast, promising domestic and foreign investment stocks and fund products are all collected. Hoping to help investors arm themselves with reason and logic.

It is the year of the cow. Like the bull, which stands for bull market, this year’s stock market outlook is brighter than ever. Although it is a bull market, there are also experts’ diagnosis that “you have to think about the worst when it is best.” This is why the Korea Economic Daily launched the’Hankyung Fund Manager Survey’. How will the chief investment officers, fund managers, and analysts of managers, the top investment experts in Korea, forecast this year?

The main character in the first quarter is semiconductor

Out of 129 fund managers from 22 domestic asset management companies who participated in the’Hankyung Fund Manager Survey’ conducted by the Korea Economic Daily, 54.5% predicted that in the first quarter of this year, 54.5% would exceed the KOSPI index of 3000. Semiconductor (25.2%) was the dominant industry that will lead the market in the first quarter of this year. It is observed that the effect of the’semiconductor rise cycle’ will start from the fourth quarter of last year and continue until the first quarter of this year. “Samsung Electronics and SK Hynix’s market capitalization exceeds one-quarter of the total stock market, but the semiconductor cycle hits the bottom in the first quarter of last year and rises. The stock price will continue to rise until the quarter.” In addition to semiconductors, fund managers cited rechargeable batteries (14.4%), bio (11.3%), and automobiles (8.8%) as their flagship businesses in the first quarter.

As for the sectors that are expected to be adjusted at the beginning of the year, BBIG (battery, bio, internet, and game), which surged last year, was cited. 36.4% of respondents said that there is a possibility of adjustment in the BBIG sector. In particular, they were wary of bio stocks, which rose sharply last year.

Despite these concerns, 35.7% of fund managers predicted that the KOSPI index would rise 5-10% in the first quarter of this year. It is expected that the era of 3000 KOSPI will be opened. Among managers, 17.8% predicted that the stock price would rise by 10-20%. Macquarie Investment Trust Management (CIO), the head of the Equity Management Division of the Foremen University Investment Trust Management (CIO), predicted that “a steeper-than-expected rise may come from a situation where stock prices are rising based on personal liquidity.

5:3:2 strategy recommendation

Behind the view that many fund managers see the first quarter of this year as the point of reaching the KOSPI index of 3000, there is also a concern that a correction may come in the stock market that has risen sharply. “The stock market will have a clear trend of’up and down’ in the stock market next year,” said Mr. Cho Yong-hwa. “The adjustment may come when the US long-term bond interest rate hikes and domestic short sales resume.”

Various analyzes come up as to the timing and reason for the adjustment. There are even observations that the adjustment may begin at the end of January when US President-elect Joe Biden takes office as early as March, when short selling resumes.

When it comes to portfolio strategy, there were many opinions that the share of stocks in domestic, emerging and developed countries should be maintained at 5:3:2. Fund managers who responded to the questionnaire cited domestic stocks with 49.6%, or half, as a promising asset this year. However, they answered that the development of corona vaccines and treatments (28.0%) and reduction of liquidity by governments (13.1%) could be variables. It means that the market may fluctuate depending on the Corona 19 situation and the government’s response.

“A 6-10% yield target is appropriate”

Fund managers who cited stocks as promising investment destinations answered that 6-10% of this year’s stock investment target rate is appropriate. 38.8% picked 6-10% as the target rate of return that can be achieved through stock investment this year. Managers who picked 11-15% returns were 33.3%, and 15.5% managers said they deserve high returns of 16-20%.

Considering that the average return of all equity-type funds reached about 30% last year and the KOSPI index rose 24%, it is evaluated that it has turned somewhat conservatively. Sang-jin Sang-jin, head of the Korea Investment Trust Management Equity Management Division, said, “The KOSPI index may reach the 3000 line, but everyone is dubious about whether it will rise above that level.” Lee Kun-min, head of the stock management division at BNK Asset Management, also predicted, “If there is no additional inflow of foreigners this year, there is a possibility that the stock market will unfold as the KOSPI index continues to fluctuate at the 3000 line.” Most respondents said that this year’s GDP growth rate in Korea will be around 1-3%, with 47.7%.

“There is a possibility that listed companies’ operating profit will increase by more than 40% this year from last year,” said Jung Sang-jin, head of the headquarters. “However, it is necessary to take into account the fact that such a forecast is reflected in the current stock price.”

Reporter Jaewon Park/Hyungju Oh/Bumjin Jeon [email protected]