cacao(484,500 +2.32%)The stocks are split at a 5 to 1 ratio.

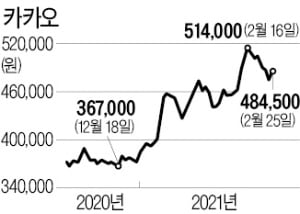

On the 25th, Kakao announced after the closing of the market that it had decided to split the stocks at face value to increase the number of stocks in circulation. When the par value division proceeds, the par value per share decreases from 500 won to 100 won. Kakao’s current share price is 484,500 won, and after the split, the price per share drops to 90,000 won. The number of issued stocks will increase from 88.6 million 4620 to 435,023,100.

With par value split, companies can increase the number of shares without capital increase, and can expect additional inflows from individual investors by lowering the price per share. Apple and Tesla, which went through a stock split last summer, increased their stock prices on the first trading day after the split. Investors who expected the stock price to increase began to buy Kakao in after-hours trading, ending the deal at 508,000 won, up 4.85%.

The transaction will be suspended from April 12 to 14 and resumed at the par value the next day.

Kakao’s face-to-face split is deeply related to the surge in stock prices since the outbreak of Corona 19 at the beginning of last year. Kakao’s stock price was around 150,000 won at the beginning of last year. However, since April of last year, it has been spotlighted as a representative non-face-to-face beneficiary, and the stock price has once exceeded the 500,000 won mark.

Reporter Hankyung [email protected]

Ⓒ Hankyung.com prohibits unauthorized reproduction and redistribution