Coupang’s stock offering price was set at $35 per share (3,9791 won). At the public offering price range, Coupang’s corporate value will reach 72 trillion won. Coupang ranked third after Samsung Electronics and SK Hynix in terms of market capitalization of domestic companies after 10 years of establishment.

The public offering of the US New York Stock Exchange is decided at $35 per share.

Coupang announced on the 11th that “the public offering price for 130 million shares (Class A common stock) subject to public offering in the US New York Stock Exchange was calculated at USD 35 per share.” It was raised from the initial public offering price of 27-30 dollars per share, which was the initial hope. The corporate value, which was about 58 trillion won, also increased by 14 trillion won. Coupang’s stock will be traded on the New York Stock Exchange (NYSE) on the 11th (local time), and the public offering process ends on the 15th.

Coupang’s corporate value is the third largest among Korean companies, following Samsung Electronics (489 trillion 522.2 billion won, based on the 11th closing price) and SK Hynix (99,7363 trillion won). The corporate value of LG Chem, which continues to be strong based on the competitiveness of batteries for electric vehicles, stands at 66,286.2 billion won. It is difficult to even compare to the eldest brother of offline retailers, Lotte Shopping (3,606.8 billion won) or E-Mart (4,948 trillion won).

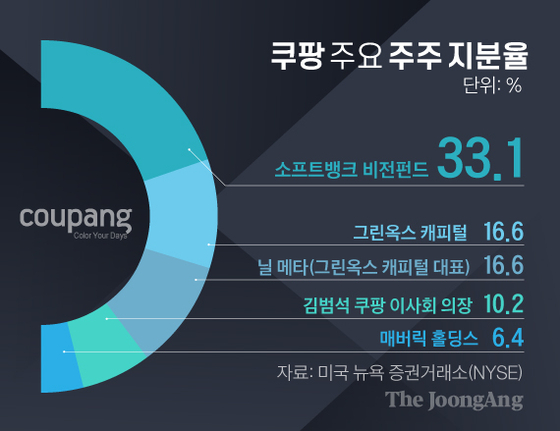

Share of Coupang’s major shareholders. Graphic = Reporter Kim Kyung-jin [email protected]

Bum-seok Kim, Chairman of Coupang’s Board of Directors, succeeded in establishing a live cartridge while solidifying the stake (10.2%) and voting rights (76.7%). With the success of the listing, he has more than 6 trillion won in stock alone. Although it is difficult to compare horizontally, the value of the stake held by Samsung Electronics Vice Chairman Lee Jae-yong (as of the end of last year) is 9,704 billion won, and Chung Mong-koo, honorary chairman of Hyundai Motor Group, is 4,945.7 billion won. If the stock price rises as Coupang shares start trading, the value of the holdings may increase.

When Coupang entered the New York Stock Exchange, the’Intentional Deficit Test’, which has been continuing for 10 years since its founding in 2010, is also a successful work. In addition, the SoftBank Vision Fund, which pushed in funds as it devoted itself to Coupang, is also expected to be the largest beneficiary. In particular, Son Jeong-eui, chairman of Japan’s Softbank Group, was relieved from a situation where he lost his face due to a series of investment failures.

Coupang user trend. Graphic = Reporter Kim Kyung-jin [email protected]

Although Coupang succeeded in listing on the US stock market, it is an analysis that the real challenge begins now. First of all, the success of listing on the stock market does not necessarily mean a successful company. Coupang has recorded a cumulative deficit of $4.118 billion (about 4.5 trillion won) over the past 10 years. In addition, as Coupang himself revealed, competition in the domestic e-commerce market is getting fiercer. Lotte and Shinsegae, the strongest players in the distribution industry, as well as IT giants such as Naver and Kakao are preparing for a battle with Coupang.

Therefore, it is unclear whether Coupang will continue to grow rapidly as it is now. There are also constant concerns over Coupang’s high-intensity working environment, which is represented by the death of a delivery driver. In this regard, the Financial Times (FT) recently reported that “the deaths of Idan workers are clouding the listing of Coupang,” and that “the possibility of Coupang’s long-term growth is questioned.”

Reporter Lee Soo-ki [email protected]

![]()