|

|

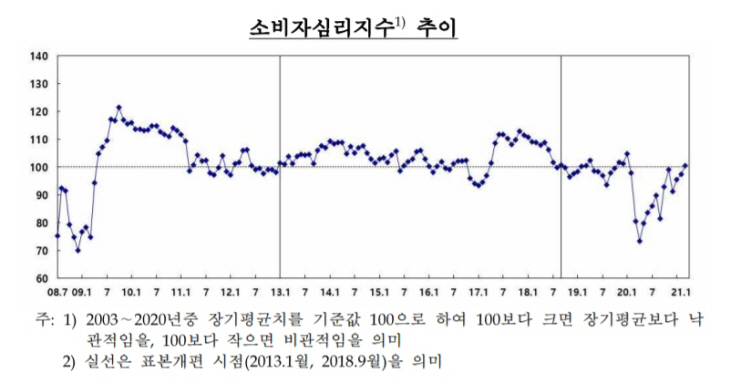

▲ Consumer sentiment index. |

[에너지경제신문 송두리 기자] Consumer sentiment has recovered to the level before the spread of the novel coronavirus infection (Corona 19). As vaccination began and export conditions improved, consumer sentiment improved for the third consecutive month.

According to the results of the Bank of Korea’s March Consumer Trends Survey (March 9-16) on the 26th, the Consumer Sentiment Index (CCSI) for March was 100.5, up 3.1 points from the previous year. As the index rose for three consecutive months, it exceeded 100 for the first time since January last year (104.8), when Corona 19 began to spread.

CCSI is calculated by using six indices, including current life style, life style outlook, household income outlook, consumption expenditure outlook, current business judgment, and future business outlook, among the 15 indices that make up the Consumer Trends Index (CSI). If it is lower than 100, it means that consumer sentiment is pessimistic compared to the long-term average (2003-2020).

A BOK official said, “Of the six indices used to calculate the CCSI, the remaining five indices after subtracting the household income forecast index were close to the overall long-term average line,” he said. “(Before Corona 19), it can be seen that they have recovered to normal levels.” He explained, “If the social distancing stage is eased, the sentiment to consume more immediately has increased.”

By CCSI composition index, the current life style letter index (89) and the life style prediction index (95) rose 2 points and 1 point, respectively, from the previous year.

The consumption expenditure outlook index (107) rose 3 points. It is close to last year’s January (110).

The current economic judgment index (72) and the future economic outlook index (93) rose 9 points and 3 points, respectively. However, the household income forecast index (96) was the same as the previous one.

Among the indices not included in the CCSI, the housing price outlook index (124) fell 5 points from the previous year. After breaking the highest level by the end of last year (132), it has been down for three consecutive months since January this year.

A BOK official said, “With the announcement of a plan to promote new public housing, one of the plans announced by the government to expand housing supply in metropolitan areas, expectations for a rise in house prices have weakened.”

The inflation level outlook index (146) and the current household debt index (104) rose by two points. The current household savings index (93) and the household savings outlook index (95) rose by 1 point.

The wage level forecast index (112) and the household debt forecast index (99) remained at the level of January.

The interest rate level outlook index (114) rose 10 points from the previous year. The increase was the largest since December 2016 (+12 points). The employment period index (84) rose 4 points.

The inflation rate, which evaluated the consumer inflation rate a year ago and the consumer inflation rate after a year, was 2.1%, both increased by 0.1 percentage points.

Reporter Song Doo-ri [email protected]