Insurance researchers recently predicted that this year’s life insurance industry will grow -0.4%, negatively from last year. Although it grew 2.5% last year, the situation is expected to become even more difficult this year. The non-life insurance industry, which grew 6.1% last year, is expected to grow only 4.0% this year. As the impact of Corona 19 last year reversed, insurance profitability improved and asset management profits increased. However, it is an analysis that this year will return to negative again.

Kim Si-joong, head of the Insurance Research Institute, said, “The insurance industry recorded a temporary high growth last year.”

He said, “As the introduction of new business models to replace traditional business models with large limits on growth is delayed, the growth gap in the current insurance industry is expected to be inevitable.” “We are looking forward to lowering our growth expectations and improving the constitution for a new leap forward. We should use this as an opportunity.”

In a recent report, Kim Yong-moo, a researcher at Deez, said, “The aging of the Korean population is progressing rapidly.” “The aging population contributes to the profitability and capital adequacy of domestic insurance companies due to the decline in demand for major insurance products such as death guarantees and auto insurance. It will have a negative impact.”

Researcher Kim said, “For future growth, insurers will increase tertiary premiums, such as health insurance, with low sensitivity to interest rate fluctuations and low capital requirements.” However, there is a possibility that it will be difficult for insurers to maintain creditworthiness only by expanding new insurance such as tertiary insurance. He explained.

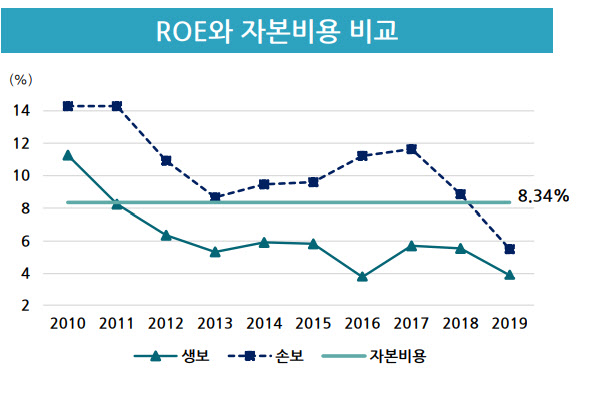

In fact, the profitability of insurance companies is declining. The Return on Equity (ROE), which represents the return on capital entered, has also decreased to level 3 compared to 10 years ago. Life insurers’ return on equity fell from 11.3% in 2010 to 3.9% in 2019, while non-life insurers’ return on equity fell from 14.3% to 5.5% in the same period.

In particular, in the case of the existing insurance industry, the interest rate is low and management efficiency is low, so there is little profit. As of 2019, the rate of return on disposition of bonds by insurers is 62% for life insurers and 87% for non-life insurance. In fact, the insurance industry’s losses are compensated by investment gains.

Inside and outside the insurance industry, there is a growing voice that insurance companies need to change products and channels to meet customer needs and change their asset management structure in order to achieve low interest rates and growth.

An insurance researcher official said, “The main growth strategy currently used by insurance companies is leading to non-recruitment competition. As platform companies dominate the market recently, the insurance industry environment is expected to change.”

“Insurance companies should pay attention to the prolonged recession, changing demand for risk coverage of individuals and businesses, changing personal characteristics of consumers, and the development of goods and services that consumers can share and experience.” “Consumers evaluate and purchase insurance products. It’s important to understand the types of decisions you make in each process, such as expertise, and incorporate them into your product hiring strategy.”

|