The Korea Insurance Institute recently predicted that this year’s life insurance industry will grow negatively to -0.4% from last year. Although it grew 2.5% last year, it is expected that the situation will become more difficult this year. The non-life insurance industry, which grew 6.1% last year, is expected to grow only 4.0% this year. Last year, there was a reflection benefit from Corona 19. Insurance profitability improved and asset management profits increased. However, it is an analysis that records that this year will return to negative again.

“The insurance industry achieved temporary high growth last year,” said Kim Se-joong, head of the Insurance Research Institute.

He said, “As the traditional business model has a significant growth limit and the introduction of a new business model to replace it is delayed, the growth gap of the insurance industry is expected to be inevitable for the time being.” He said, “It is expected to lower expectations for growth and improve the constitution for a new leap forward. It is necessary to use it as an opportunity.”

Researcher Kim Young Moody’s also said in a recent report, “The population aging in Korea is rapidly progressing.” “As the demand for mainstream insurance products such as death guarantees and auto insurance is declining, this population aging is contributing to the profitability and capital adequacy of Korean insurance companies. It will have a negative effect.”

Researcher Kim said, “For future growth, insurers will reinforce the proportion of third insurance such as health insurance with low sensitivity to fluctuations in interest rates and low capital requirements.” However, there is a possibility that it is difficult for insurers to maintain creditworthiness only by expanding new insurance such as third insurance. There is” he explained.

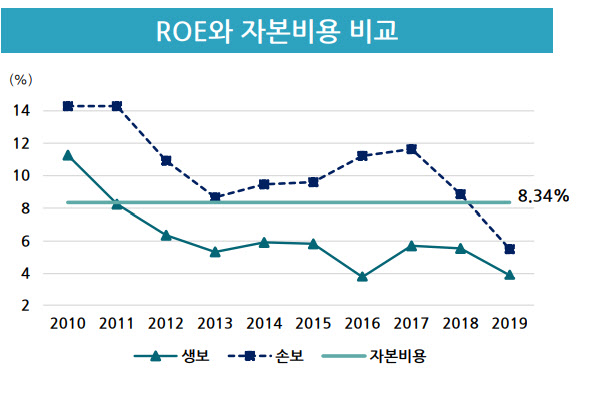

In fact, the profitability of insurance companies is on the decline. The return on equity (ROE), which represents the ratio of return to input capital, has also declined to a third level compared to 10 years ago. Life insurers’ ROE fell from 11.3% in 2010 to 3.9% in 2019, and non-life insurers’ ROE fell from 14.3% to 5.5% in the same period.

In particular, in the case of traditional insurance business, little profits are made due to low interest rates and a decline in operating efficiency. As of 2019, the proportion of gains on disposal of bonds by insurance companies in net income was 62% for life insurers and 87% for non-life insurers. In fact, the loss in insurance business is offset by investment gains.

Inside and outside the insurance industry, there is a growing voice that insurers need to change their asset management structure and change products and channels tailored to consumer needs to break through low interest rates and growth.

An official of the Korea Insurance Research Institute said, “The top-line growth strategy used by existing insurance companies is leading to excessive competition for recruitment fees. Recently, as platform companies with market dominance emerge, the landscape of the insurance business environment is expected to change.”

“Insurance companies are required to pay attention to the prolonged economic downturn, change in demand for risk guarantees of individuals and companies, and changes in personal characteristics of consumers, and to develop products and services that enable consumer participation and experience.” “Consumers evaluate and purchase insurance products. It is necessary to grasp what kind of decisions are made in each process, such as experience, and reflect them in the product recruitment strategy.”

|