Will LG OLEDㆍSamsung QD (Quantum Dot) bloom delay?

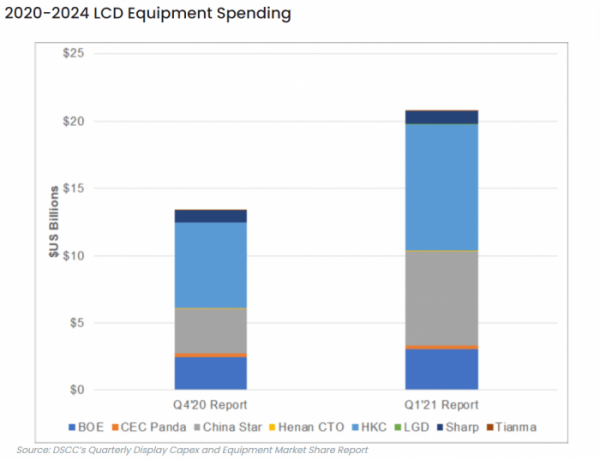

▲ Changes in LCD equipment expenditures from 2020 to 2024 (Source = DSCC)

As the dying LCD (liquid crystal display) market is on fire again, Chinese display companies are increasing their facility investment significantly. Some are concerned that the opening of the next-generation display market led by domestic companies such as OLED (organic light emitting diode) and QD (quantum dot) may be delayed.

On the 17th, market research firm Display Supply Chain (DSCC) raised its LCD equipment expenditure forecast for 2020-2024 to $ 20.7 billion through the latest report. It has increased the forecast by a whopping 55% from the $13 billion level forecast in the report released in the fourth quarter of last year.

After last year’s new coronavirus infectious disease (Corona 19) pandemic, it is interpreted that the LCD industry is reviving due to the rise in demand for zipcocks including working from home, and it is said to show a’roar when it comes to color’.

Currently, LCD manufacturers are mainly formed by Chinese companies such as BOE, China Star, and HCK.

DSCC explained that “LCD companies are trying to increase their production capacity as much as possible through small expansion and operation of new fabs due to rising prices and increasing confidence in continued growth.”

He said, “The LCD industry is also reducing the performance gap with OLED through high-end products such as mini LED this year.”

As such, unexpectedly, the LCD market is revived, and there are concerns that there will be a disruption in the full-scale growth of next-generation displays led by Korea.

Samsung Display and LG Display, which were the existing LCD powerhouses, changed their direction to next-generation displays as their profitability deteriorated due to the aggressive of low-priced products by Chinese companies. LG Display is all-in on OLED, and Samsung Display is making large-scale investments with QD display as the next-generation growth engine.

An official in the display industry said, “The LCD boom will not last long,” but said, “There are many variables such as Corona 19, and there is no concern that the demand for next-generation displays will decrease with the growth of LCD.”

Samsung and LG plan to lead the future display market with differentiated performance.

LG Display is investing hundreds of billions of won every year to advance OLED technology. Through this, the burn-in (screen persistence) phenomenon, which has been pointed out as a weakness of OLED, and lifespan are improving.

It has diversified its product portfolio within OLED as well. In particular, there are more than 20 OLED TV manufacturers that apply large OLED panels produced by LG Display.

Samsung Display is also focusing on securing the QD display yield (the ratio of good products to the total product) and is striving to accelerate the timing of mass production. In particular, with the government approving the sale of the Suzhou LCD production line earlier this month, Samsung Display is expected to accelerate its QD business transformation.

An official from Samsung Display said, “We are preparing to release QD display products in a timely manner.”