Concerns about accelerating sales and chartering next year

Last updated 2020.12.24 11:25Article input 2020.12.24 11:25

[아시아경제 김유리 기자] “If you’re going to do this, don’t buy a house.” There is growing concern that next year demand for cheonsei will turn to trading demand. This is because the average rent per household in Seoul has exceeded 500 million won, making it possible to prepare a home in most areas of the metropolitan area for the same price. It is predicted that the conversion of jeonse demand will accelerate next year as it is the diagnosis of experts that it is difficult to resolve the jeonse crisis, given the sharp decline in occupancy volume and strengthening requirements for real-time homeowners.

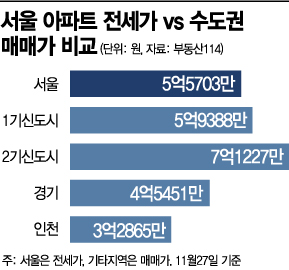

According to Real Estate 114 on the 24th, the average jeonse price per household in Seoul as of the 27th of last month was 55.7 billion won. This is equivalent to the average sale price in major regions such as the metropolitan area. In fact, the average selling price per household in the metropolitan area is 4,5451 million won in Gyeonggi and 328.65 million won in Incheon, far exceeding the average jeonse price in Seoul. Even the Seoul rental price is only 36.8 million won different from the average selling price per household in the first new city of 59388 million won. The number also confirms the sentiment of’living in the metropolitan area rather than struggling with the jeonse crisis’. However, the average selling price per household in the second new city was 712.27 million won, which is still about 150 million won different from the Seoul rental price.

The difference between the jeonse price and the sale price per household, which allows estimating the amount of money a cheonsei resident needs to buy a house, also exceeded 500 million won in Seoul (517.75 million won), while the burden was relatively light at 150.45 million won in Gyeonggi and 97.99 million won in Incheon. .

The problem is that the jeonse crisis centered on Seoul has no sign of getting better next year. The planned number of apartments in Seoul next year is 27,341 households, which is expected to be cut in half compared to 52,89 households this year. In addition, various real estate policies to curb the demand for buying and selling such as mandatory real residence in the case of mortgage loans within the regulated area, reinforcement of real residence requirements that are exempt from transfer tax, special deduction for long-term possession of high-priced housing, and real residence requirements for two years of reconstruction are implemented. The situation is accelerating, and the chartered sale is falling sharply. The reorganization of the subscription market focused on real residents also affected the imbalance in supply and demand for jeonse. According to the Korea Institute of Construction Industry, charter transactions for new apartments with 100 or more units in Songpa-gu, Seoul, reached 64.1% in February 2018, but fell to 26.6% in June this year.

In the Seoul area, there are also observations that the demand from jeonse to trading will increase further. As the rate of increase in jeonse prices reaches 2 to 3 times the rate of increase in trading prices, the gap between trading and jeonse prices is narrowing. Jihae Yoon, senior researcher at Real Estate 114, said, “The narrower the difference between the jeonse price and the sale price, the longer the cheonsei crisis, the greater the tendency to change from the cheonsei market to the trading market.” “It can be done.”

Reporter Kim Yuri [email protected]