[서울=뉴스핌] Reporter Lee Jeong-yoon = The index of the financing cost index (COFIX·Cofix), which is the basis for calculating the fluctuation rate of bank mortgage loans, fell at once.

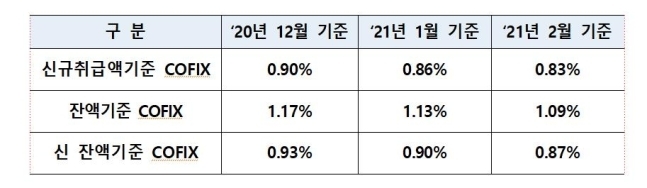

On the 15th, the Federation of Banks announced that last month’s new handling amount was 0.83%, down 0.03 percentage points (p) from the previous month. It has been down for two consecutive months since it recorded 0.90% in December of last year.

COPIX is a weighted average of the interest rates of funds raised by eight domestic banks, including regular deposits, financial bonds, and transferable deposit certificates. The new handling amount co-fix is calculated for the funds newly raised by the bank in the month, and reflects the fluctuations in the market interest rate relatively fastest.

|

| (Photo = Bank Federation) |

Based on the balance of the same period, the cofix was 1.09%, down 0.04%p from the previous month. Co-fix, based on balance, fell for 1 year and 11 months (23 months) in a row after recording 2.02% per year in March 2019.

Cofix, based on the new balance introduced in June 2019, recorded 0.87%, down 0.03%p from the previous month. Co-fix, based on the new balance, also fell to 1.66% in July 2019, a month after the first count. It remained below 1% for four consecutive months.

The short-term cofix calculated for short-term funds, which is a 3-month contract maturity, was 0.70~0.75% based on the published interest rate for the last 4 weeks.

Accordingly, commercial banks will reflect the level of the February Cofix rate, which was disclosed on the day, in the new home mortgage loan variable rate starting on the 16th. In the case of a consumer receiving a variable-rate mortgage loan, if the additional and preferential interest rates remain the same, the loan rate will be adjusted by the amount of change in the cofix that was used as the basis for the initial loan.

The Federation of Banks said, “If you want to receive a cofix-linked loan, you need to carefully select a loan product after understanding the characteristics of such Cofix.”