![[김현석의 월스트리트나우]](https://i0.wp.com/img.hankyung.com/photo/202103/01.25696188.1.jpg?w=560&ssl=1)

News from Europe before the opening of the New York Stock Exchange on the 11th (local time) boosted investors’ confidence.

The European Central Bank (ECB) issued a statement after ending its monetary policy meeting and announced in the second quarter that it had decided to significantly increase the speed of bond purchases through the Pandemic Emergency Purchase Program (PEPP) from the first quarter. It will freeze the base rate and keep the PEPP cap, while temporarily accelerating the purchase rate to respond to the rising interest rate. Both the bond market and the stock market were hoping the ECB would stop the interest rate from rising, and that was fixed in the first part of the statement.

![[김현석의 월스트리트나우]](https://i0.wp.com/img.hankyung.com/photo/202103/01.25696196.1.jpg?w=560&ssl=1)

The ECB also raised its inflation estimate this year from 1% to 1.5%. “Inflation will rise, but it will be temporary,” Governor Christine Lagard said at a press conference. On this day, the ECB’s actions were generally interpreted in a way that was dominated. “The ECB has taken action to cope with rising government bond rates,” said Maeva Kujin, Economist of Bloomberg Economics. “This gives the market a sense of relief.”

Wall Street was greedy. The ECB’s actions reminded me of the US Central Bank (Fed) hosting the Federal Open Markets Commission (FOMC) next week. A Wall Street official said, “The ECB’s actions raised the market’s expectation that the Fed would not approach it like the ECB at next week’s meeting,” he said. “However, because the US is faster than Europe and the economic outlook is improving faster. I don’t know if I’m going to do something similar.”

The number of weekly unemployment benefits claims in the United States, which followed soon, was also announced at 712,000. It was 42,000 cases down from the previous week and less than the Wall Street forecast (725,000 cases). This is the lowest since the first week of November last year. In addition, the number of job openings for January announced by the Ministry of Labor was 6917,000, up from 6752,000 in December last year.

![[김현석의 월스트리트나우]](https://i0.wp.com/img.hankyung.com/photo/202103/01.25696189.1.jpg?w=560&ssl=1)

This is in line with the February employment index released last week. The number of new hires in February was 379,000, far exceeding the market forecast (200,000). In particular, despite the cold wave and power outages, 355,000 jobs in the leisure and hospitality industry have soared. This is because, as each state’s indoor dining restrictions were lifted one after another, restaurants and pubs alone employed 286,000 more people last month.

The yield of 10-year U.S. Treasury bonds, which had been quiet due to inflation concerns (1.7% of the February Consumer Price Index) and a successful bid of 38 billion dollars, fell to the 1.4% range early in the early morning of the day. After the ECB statement was released, it traded at 1.488%, with a record low of 1.479% on the day.

The bid for 30 years in the morning was just fine. The winning bid rate was 2.295% per year, 0.5bp higher than the previous market rate. The bid rate was 2.284 times higher than the recent average of 2.176 times, but it was less than the average of 2.336 times.

The expectation that foreign investors such as Japan will return due to the interest rate that has risen to 1.5% per year has also risen. According to Bloomberg, Japanese investors sold $34 billion worth of government bonds for two weeks until early March, but turned back to buying slightly last week. Bloomberg analyzed that if you look at the 10-year yields of each country, you can get interest rates higher than 1% by buying U.S. Treasury bonds in terms of currency hedging.

![[김현석의 월스트리트나우]](https://i0.wp.com/img.hankyung.com/photo/202103/01.25696191.1.jpg?w=560&ssl=1)

As interest rates stabilized, the New York stock market rebounded significantly. In particular, technology stocks, which were negatively affected by rising interest rates, jumped significantly. Tesla rose 4.7%, and Apple, Facebook, Alphabet, and Netflix all went up. In particular, when the China Semiconductor Industry Association (CSIA) announced that it has established a working group to discuss export control and supply chain security issues with US technology companies, semiconductor stocks surged, with NVIDIA and Broadcom rising by 4%.

In the end, the Dow rose 0.58%, the S&P 500 rose 1.04%, and the Nasdaq surged 2.52%. The Dow and S&P 500 index soared to an all-time high, and the Nasdaq, which had fallen by 10% from its highest on Monday this week, is back below 5%.

The index recovered, but when looking at stock prices by stock and sector, it is analyzed that about 20% of the bubble has been removed from areas that have soared, such as newly listed stocks, SPAC, and Arc Invest’s Listed Index Fund (ETF). In addition, the stock price-to-earnings ratio (P/E) also slightly decreased from 23x to 22x. The horror and desire indexes compiled by CNN and others have also come down to an appropriate level. So, some pointed out that the stock price has become more attractive.

If these levels remain until Friday, this week will be the highest in the last five weeks when interest rates began to fluctuate.

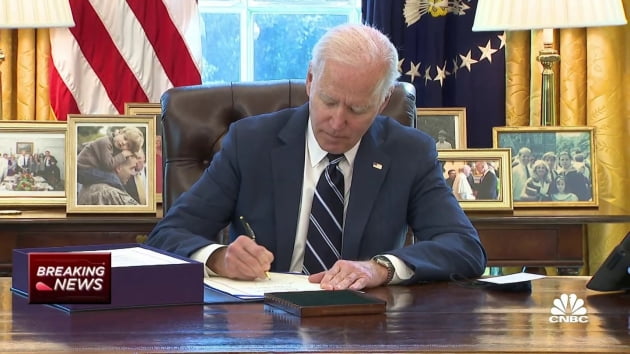

Plus, in the afternoon, President Joe Biden signed a stimulus package one day earlier than expected. The White House explained that starting this weekend, checks of $1,400 per person will start depositing into accounts.

![[김현석의 월스트리트나우]](https://i0.wp.com/img.hankyung.com/photo/202103/01.25696194.1.jpg?w=560&ssl=1)

Pfizer and the Israeli Ministry of Health announced that it was 97% effective in preventing symptomatic infection, severe patient incidence, and death as a result of an analysis of vaccination data. In addition, asymptomatic infection prevention effect was 94%.

Wall Street is preparing for a full-fledged economic recovery. In a podcast, Morgan Stanley chief economist Ellen Gentner and US stock strategist Adam Birgadamo gave future outlooks for the US economy and stock markets, which will resume the economy and free up an additional $1.9 trillion in vaccine penetration. Let’s summarize this.

Vaccinations, economic resumption, and economic recovery are progressing faster than last year’s expected timeline. The first is thanks to the stimulus package passed at the end of last year. Gross domestic product (GDP) growth in the first quarter is expected to reach about 8%. It’s an incredibly powerful start to the year.

Also, the distribution of the vaccine is consistent with our expectations so far, but I think more people will receive the vaccine from April. In recent years, the amount of vaccines distributed daily and the number of actual vaccinations are increasing much faster than expected. At the same time, the economic resumption started earlier than we expected. So, already in early February, more jobs have begun to recover at an alarming rate.

The $1.9 trillion stimulus package will soon take effect. Checks for $1,400 per person will soon start depositing into people’s accounts. It will be done in a few weeks. The US Revenue Service (IRS) has already done this a few times.

In recent years, households tend to use stimulus checks within 10 days of receiving them. In other words, they are no longer saving and consuming because of an uncertain future. Therefore, spending can be significantly increased in late March and early April. This will be a powerful bridge for the US economy to regain jobs. Then, the labor income will gradually recover. This is why we expect the U.S. GDP growth to reach 8% this year.

-When the first stimulus check was paid in April last year, a large amount of savings was saved. Not only was the future uncertain, the economy was blocked, and people couldn’t use it even though they tried to use it.

Of course, there will be people who are saving this time as well. So, in the US, the savings rate in the first quarter will rise again to 20%. As you can see, the US already has an additional $1.5 trillion in household savings after the pandemic. When the stimulus package and this stimulus package are added in December, the savings are expected to exceed about 2 trillion dollars. This will act as a tremendous consumer purchasing power when the economy resumes. Americans have a very high repressed demand for services.

This is one of the reasons why inflation is expected to rise. Because enormous demand can meet supply bottlenecks.

![[김현석의 월스트리트나우]](https://i0.wp.com/img.hankyung.com/photo/202103/01.25696192.1.jpg?w=560&ssl=1)

-January employment was disappointing. However, it was not unexpected because the US economy did not resume.

Looking at employment in February, we saw hundreds of thousands of jobs coming back and recovering in the leisure and hospitality sector, especially in restaurants. That was only a small effect of restricting restaurant operations in some states. There is continuing openness and news is coming that more states are lifting restrictions. About 500,000 jobs were created in the private sector in February, so if the economy continues to open up quickly, employment will be exceeded and that will be the standard.

Morgan Stanley looks forward to strong job creation this year. Recently, the unemployment rate forecast was lowered. The unemployment rate is expected to drop to 5% by the end of this year and below 3.9% by the end of next year. That’s a V-shaped recovery. The V-shaped recovery of the economy and tremendous fiscal stimulus will make it.

-How should investors access stocks now? It should be’optional’. Stock prices have risen higher from the index level, and corporate earnings expectations are higher than previous highs. At the same time, we expect interest rates to rise and the P/E ratio to shrink slightly.

What we expect for the next year is a bit of a tug of war. It is a fight between rising corporate earnings expectations, the pace of economic recovery, and high P/E. a little. Overall, I think the main indices have room for a little upside, but I think it’s a type of tug-of-war, that is, there is a possibility of going up or down. do.

We will begin to get data on what the post-pandemic spending will look like over the next few months and what the consumption patterns will look like in the future. Key keywords are retention, reversion, and stock price. Yuji means to maintain the benefits of the pandemic. Also, returning means returning to the level before the pandemic. Travel owners will be a clear example.

Investors now need to differentiate between stocks that are appropriately dictating what will change with the economic resumption and those that are not.

The survey results show that the market has high expectations for stocks related to home consumption, such as semiconductors, home entertainment, Internet services, communication software, and some communication software, even after the pandemic. Some are heaped up with anticipation of a strong economic cycle. What we’re advising is that’should be more selective’. It is necessary to see if the expansion of the economic cycle can meet high expectations.

In some areas, the options are wide. Banking and consumer finance, services, energy, advertising (especially outdoor advertising), discount retail, food distribution, and corporate service sectors. These companies are considered to be in an environment with high potential for upside.

In areas that have benefited from the pandemic, many have a positive view on the sector related to e-commerce. As more people buy online due to the pandemic, consumer spending and buying patterns are becoming more digital. I expect the economy to resume and consumers will return to offline stores, but in the long run, I think this pandemic has accelerated the penetration curve of e-commerce.

We are also seeing increased data and digital customer engagement. Along with this, we are also paying attention to industries that can expect earnings to rise amid economic recovery through enormous fiscal stimulus measures.

However, although it was quiet on this day, concerns about the interest rate that will survive with the economic recovery are still lurking. “We will see super-strong economic indicators as the US economy normalizes over the next few months,” Bank of America said. It is virtually impossible for the Fed to inform the market that it will not go in the direction of normalizing its easing monetary policy. It will work.”

Reporter Kim Hyun-seok [email protected]