As China’s future economy focuses on the’domestic market’, an analysis suggests that Korean companies need to prepare preparations. This is because changes in existing exports to China have become inevitable as China decided to reduce the proportion of imports of intermediate goods and expand the use of parts and materials by domestic companies. In particular, some point out that China should maintain the high-tech advantage of Korean companies as it is expected to increase the degree of independence of components such as semiconductors in the long term.

This is included in the report on the’Overseas Economic Focus’ published by the Bank of Korea on the 21st,’Checking the characteristics of recent Chinese import demand and future conditions.’

‘Dual Cycle Strategy’, the basis of China’s economic change

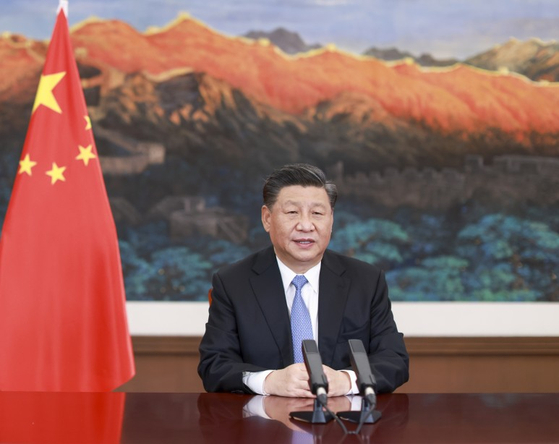

Chinese President Xi Jinping. China’s strategy for changing the economic structure is based on the’double cycle’ proposed by President Xi Jinping in May of last year. Shinhwa Communication

China’s strategy for changing the economic structure is based on the’double cycle’ proposed by President Xi Jinping in May of last year. The basic gist is the virtuous cycle of domestic economy (large domestic circulation) and international export (large international circulation). The strategy is to shift the paradigm from the existing export-led growth to growth using the expansion of the domestic market. It is planning to put down the role of a’world’s factory’ that buys intermediate goods and exports finished products, and raises its domestic potential.

This is an exit strategy to raise the recently sluggish economic growth rate. China’s economic growth rate remained at 10% until the 2010s, but gradually slowed down and fell to the 6% level last year.

It is also due to the growing importance of high value-added industries such as parts and materials and advanced technology. The trade dispute between the U.S. and China, which continued from 2018, spread to the competition for high-tech initiatives. A prime example is the decision to take over China’s leading social media’TikTok’ to an American company after the US sanctioned Huawei, a leading 5G semiconductor company in China last year.

To this end, China has designated the transition to high value-added industries such as parts and materials such as semiconductors and advanced technology as a core priority of the dual-cycle strategy, and then plans to localize the supply chain to raise the localization rate of parts and materials in the top 10 industries to 70% by 2025. Built up.

China’s economic strategy changes in the long term’dark clouds’

According to China’s bicyclical strategy, it is highly likely that it will be a bad thing for domestic export companies in the mid to long term. It is expected that the share of imports of consumer goods with a low share of Korean companies will increase. Chinese Xinhua Network Capture

The change in China’s economic strategy is favorable for Korean export companies in the short term. Global Investment Bank (IB) Goldman Sachs predicts that China will contribute to 25-35% of global economic growth in 2021-24 as the economy recovers, driven by domestic demand.

This is likely to lead to an increase in exports by domestic companies. The report predicted, “With the acceleration of the global digital economy in China, the demand for imports of high-tech materials such as semiconductors and electric vehicles will increase, and exports of premium consumer goods related to beauty such as cosmetics to China will expand as consumption recovers.

However, the BOK’s analysis is that in the mid- to long-term, it is highly likely to be a bad thing for domestic export companies. This is because Korea’s imports of weak consumer goods are greatly expanded. According to the Korea International Trade Association, as of 2018, the share of China’s consumer goods market in China was 3.4%, which was significantly lower than that of its rivals Germany (12%), the United States (11.4%), and Japan (10%).

To make matters worse, it is difficult to expand consumer goods exports as Chinese consumers have high preference for domestic products and the proportion of consumer goods imported is not large. According to the report, as of July last year, the proportion of imported consumer goods in China was 3.8%, which is significantly lower than the US (12.5%) and Japan (11.1%).

The photo shows TSMC’s semiconductor wafers displayed at the 2020 World Semiconductor Conference held in Nanjing, Jiangsu Province, China in August last year.[AFP=YonhapNews[AFP=연합뉴스

In addition, as the self-sufficiency rate of high-tech parts and materials such as semiconductors in China will increase further, there is a risk that the proportion of exports of domestic parts and materials companies will decrease. According to Morgan Stanley, without additional US sanctions, China’s semiconductor self-sufficiency rate could rise by up to 40% by 2025. For this reason, some point out that it is necessary to maintain a technological advantage over Chinese companies in the long term.

The report said, “In the mid to long term, it is necessary to prepare for changes in export conditions to China as the domestic demand-oriented growth structure has been established and the domestic parts and materials supply chain has been expanded.” It is imperative not only to secure export competitiveness of Korea, but also to maintain technological superiority in advanced parts and materials.”

Reporter Yoon Sang-eon [email protected]