Input 2021.02.27 06:00

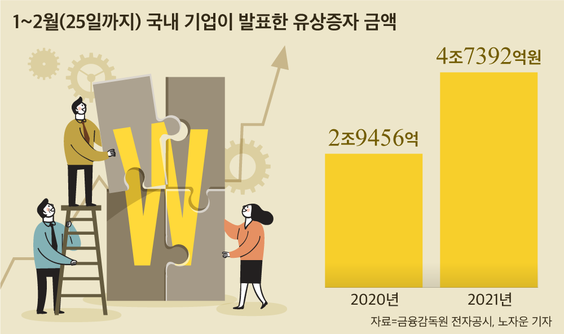

It was found that a domestic company announced a plan for a capital increase worth 4.4 trillion won for about two months this year. This is an increase of more than 60% over the same period last year.

Financial investment industry officials analyzed that the surge in paid-in capital increase is related to the aftermath of the novel coronavirus infection (Corona 19). Money is needed, but as there is a limit to the amount of money that can be raised through loans, companies are raising money through rights offerings.

Of the 4.4 trillion won, SK Bioscience’s planned increase of 740 billion won is the capital that will come through listing, so even if it is excluded in consideration of the specificity, compared to the 2,94 trillion won increase in the same period last year.

Looking at the purpose of the capital increase stated by each company, financing for the operation of the company accounted for 54 out of 77 cases. There are some companies that are raising capital for business expansion, such as BeNX, a big hit subsidiary that Naver invested 350 billion won, or Kakao Mobility, which invested 220 billion won in Carlisle ahead of listing. Remarkably many. There were also 10 cases of paid-in capital increase for the purpose of repaying debt.

Humax, a set-top box company, is a representative company that has decided to issue a capital increase for debt repayment this year. On the 17th, Humax announced a plan for a capital increase worth 44.5 billion won, of which 15.2 billion won will be used for debt repayment and the remainder will be invested in business diversification. Haesung Optics, a camera lens module maker, also announced on the 29th of last month that it would increase the capital increase of 44.6 billion won to repay its subsidiaries’ debts.

Officials in the financial investment industry saw that the rapid increase in the capital increase of companies this year is related to the economic recession caused by Corona 19. Sang-hyun Sang-hyun, head of the KOSDAQ Market Headquarters of the Korea Exchange, analyzed that “the purpose of the capital increase will be different depending on the business type and financial situation of the company, but there is a possibility that the pandemic of Corona 19 had negative effects on business operations in many ways.”

In fact, Humax and Haesung Optics, which decided to issue a capital increase to repay their debts, are suffering from deteriorating performance in the aftermath of the economic downturn caused by Corona 19. On the 16th, Humax announced that last year’s net profit turned to the red, citing the epidemic of Corona 19 as the main reason. Last year, Humax’s net loss amounted to 109.9 billion won. Haesung Optics, which recorded a net loss of 36.5 billion won during the same period, also found the reason for the poor performance in Corona 19.

Hwang Se-woon, a research fellow at the Capital Market Research Institute, said, “Since there are many cases where the value of the shares held by existing shareholders is lowered when a capital increase is made, it is more advantageous for companies to raise funds through borrowing rather than through capital increase. The fact that the increase in capital increase indicates that more companies are facing financial difficulties.”

The increase in the number of companies facing financial difficulties can also be confirmed by the increase in corporate loans by banks. According to officials from the banking industry on the 25th, the balance of corporate loans in the banking sector at the end of last month was 98.3 trillion won, an increase of 10 trillion won from the previous month. It is interpreted that companies that have suffered poor performance due to Corona 19 are receiving loans from banks and transfusion of funds through capital increase.

On the other hand, investors need to be cautious as they may suffer losses from falling stock prices depending on the method of capital increase. In the case of a paid-in capital increase assigned to a third party who decides who will buy the stake in advance, it works as a good for the stock price, but the increase in the public offering method is often a bad thing. In the case of XiS&D, the stock price fell by more than 8% the day after the announcement of a paid-in capital increase plan based on a public offering of real rights after shareholders were allocated.