On the 18th, the Financial Supervisory Service announced the inspection results of these contents at the’Real Estate Policy Promotion Status and Future Plans Joint Briefing with Related Organizations’.

The Financial Supervisory Service uncovered 25 out of 180 suspected regulatory violations that were notified by the Ministry of Land, Infrastructure and Transport’s tort response team. In all cases of detection, loans were recovered and 5 financial company employees who had reasons attributable to them, such as intention or negligence, were disciplined.

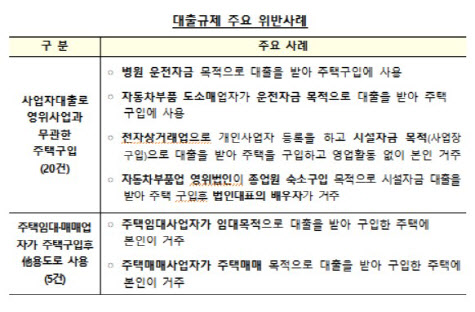

Twenty cases were purchased from business loans. This is the case when a loan is obtained for the purpose of operating a hospital and used to purchase a house, or an automobile parts wholesaler or retailer purchases a house with a loan. In some cases, after registering as an e-commerce business as a private business, they received a loan for the purpose of facility funding to purchase a house and live. An automobile parts business corporation bought a house with a loan for facility funds for the purpose of purchasing employee accommodation, and the representative spouse lived there.

Five cases were also found that were used by housing leases and dealers for other purposes after purchasing a house. △The person lives in the house purchased by the housing rental business operator with a loan for the purpose of leasing, or △the person buys the house by receiving a loan for the purpose of sale by a housing sales business operator.

The Financial Supervisory Service also conducted a theme check on the status of compliance with regulations on mortgage loans for 26 financial companies from September to October last year. As a result, it is reported that 1082 cases may have violated loan regulations, and follow-up measures such as sanctions are underway.

Examples of possible violations of the loan regulations include △Incorrect application of the guarantee ratio (LTV) and total debt repayment ratio (DSR) regulations △ negligence in contract management when handling loans △ usefulness other than the purpose of loans to business owners.

The Financial Supervisory Service (FSS) has taken measures such as banning loans for the next three years, and sanctions for employees of financial institutions, along with the collection of loans for the cases of regulatory violations.

An official from the Financial Supervisory Service said, “From this year on, we will intensively check whether or not the agreement is fulfilled because the due date for the fulfillment of the existing housing disposition conditional and transfer conditional loan agreements is in full swing.”

Along with this, it actively checks whether it is compliant with regulations on large credit loans. The financial authorities are applying DSR (bank 40%) for borrowers with an annual income of 80 million won or more on credit loans exceeding 100 million won. In the case of handling credit loans exceeding 100 million won, the purchase of homes within a year was also banned.

|