Input 2021.01.24 12:00

“Sufficient demand for US Treasury bonds and continued low interest rates… Interest repayment problem will not be big”

An analysis by the Bank of Korea that Biden’s new US government’s economic stimulus plan will not increase government debt sharply. Even if the issuance of US Treasury bonds increases, the burden of repaying interest due to the supply and demand of treasury bonds is expected to be limited as global demand remains solid and structurally low interest rates continue.

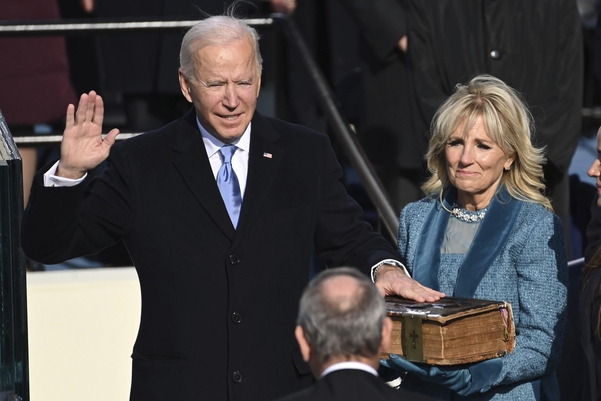

According to the “Analysis of Major Contents and Impacts of the New Government Fiscal Policy in Biden,” published by the BOK on the 24th of the Overseas Economic Focus, in the first half of this year, a stimulus plan to respond to the novel coronavirus infection (Corona 19) was executed in the US in the first half of this year. The President recently announced a new economic stimulus plan worth $1.9 trillion.

It is analyzed that the Biden government’s fiscal policy will focus on economic recovery, eco-friendly, and infrastructure expansion. The plan is to restore jobs that have disappeared due to the pandemic through large-scale infrastructure investment and build an eco-friendly energy economy. However, there are concerns about the fiscal soundness resulting from this and the imbalance of supply and demand in the bond market due to the issuance of large-scale government bonds.

For the Biden government’s fiscal expansion, it is not enough to increase tax revenues only due to tax increases, so financing through government bonds is inevitable. Due to the reduction in fiscal expenditures and tax revenues caused by Corona 19, the government’s debt to gross domestic product (GDP) has sharply expanded from 79.2% in 2019 to 98.2% in 2020. The Trump administration’s net issuance of government bonds was at an annual average of $900 billion (excluding 2020), but the Biden administration is highly likely to expand beyond this.

It is evaluated that the increase in the burden of interest repayment due to the accumulation of US Treasury bonds is limited. This is because even if government debt surges unexpectedly, global demand for U.S. Treasury bonds remains, and structurally low interest rates, unlike in the past, continue. US Treasury Secretary Janet Yellen (former Fed Chairman) emphasized strengthening policy coordination through low interest rates.

An official from the BOK said, “The fiscal expansion of the new US government is expected to have a positive impact not only on the US economy but also on the global economy as a whole.” However, if the vaccine supply is delayed or the congress fails to deal with major fiscal bills, the US economy will return to pre-crisis. There is a possibility that it will take a considerable amount of time to do this.”