Foreign media reports that the South Korean government’s repeated measures to extend the ban on short selling could adversely affect the stock market. Short selling is an investment technique that borrows and sells stocks when stock prices are expected to decline, and then buys and repays stocks when the stock price goes down.

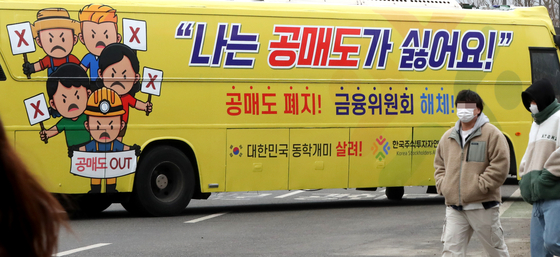

The Korea Stock Investment Association (Han Tu-yeon), a group of individual investors, is running a bus with words such as’Abolition of short selling’ and’Dismantling of the Financial Services Commission’ to campaign against short selling in Sejongno, Seoul on the afternoon of the 1st. yunhap news

“Korean Political Populism Causes Reextension of Short Sale Ban”

Bloomberg News reported on the 4th (local time) that the extension of the short selling ban could be counterproductive in an article titled “The world’s longest banned countries are putting their stock markets at risk of falling.” According to this, when the global stock market collapsed in March last year due to the new coronavirus infection (Corona 19), 12 countries including Korea entered a ban on short selling. Most countries resumed short selling in 2-3 months, and only Korea and Indonesia continued to ban long-term short selling for a year. However, Indonesia is expected to end the ban on short selling at the end of this month. As it is, Korea will be a country that has banned short selling for the longest time in the world.

Bloomberg said that many market officials, including fund managers, are concerned that “the artificial stock price support situation will eventually backfire.” An official from AMP Capital, a fund management company based in Sydney, Australia, told Bloomberg, “It is a surprising decision to extend the ban on short selling even though the Korean stock market is bullish,” he said. “Market liquidity may unintentionally drop sharply.” “The populism of Korean politics has caused the ban on short selling to be re-extended,” said Macquarie Investment Trust Management’s stock management division chief (CIO). “It is regrettable that the financial authorities are being shaken by public opinion.”

On the 3rd, the Financial Services Commission decided to extend the ban on short selling, which was scheduled to end on the 15th of next month, until May 2nd. Short selling will resume from May 3 for 350 stocks, including 200 KOSPI and 150 KOSDAQ. The ban on short selling was introduced temporarily for six months in March of last year, then extended once in September of the same year, and this time it was extended again. Accordingly, the stock market criticizes that it was “a decision that was pushed by the politics and public opinion ahead of the by-election of the Seoul and Busan markets in April.”

Reporter Hwang Eui-young [email protected]