|

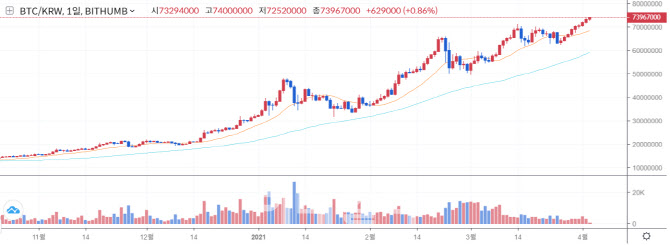

According to Bithumb, a cryptocurrency exchange on the 3rd, the price of bitcoin on this day is continuing a surge at 73.96 million won. This is an increase of more than 2.3 times from the 31.5 million won mark on January 1st this year. Bitcoin price soared to the 26 million won range in January 2018, and after peaking at the peak, it showed a dominant market in the box zone for nearly three years, and was sluggish. However, it again surpassed 20 million won in November last year, and has risen vertically after exceeding the 30 million won line this year, and is about to break through the 75 million won level.

As the price of bitcoin is soaring like an attic, the funds of individual investors are also rushing to the cryptocurrency market. However, the government will classify the profits from cryptocurrency as other income and impose a transfer tax of 20% on income exceeding 2.5 million won per year from next year.

For this reason, if an investor who bought one bitcoin on January 1 this year sells it for 74 million won, there is currently no tax. It is charged and has to pay 8 million won.

Regarding this method of calculation, individual investors are complaining about the equity investment and equity investment.

From 2023, the government plans to impose a full tax on financial investment income, and impose a transfer tax on all listed stocks if gains of more than 50 million won per year are collected. However, if there is a loss other than a margin in the current year, the amount of the loss is deducted for 5 years. For example, if you lost 30 million won through stock investment this year, you can apply the loss carry-over deduction and the basic deduction of 50 million won even if you earn 80 million won next year, and you can not pay the transfer tax.

Individual investors are complaining about the government’s tax imposition policy in online communities, saying, “Cryptocurrency is a scam that has no value, and now paying taxes is not right.”

Meanwhile, the financial authorities have defined virtual assets such as cryptocurrencies as’electronic certificates that can be transferred with economic value’ in the’Specific Financial Information Act’ (Special Act) that has been enforced since last month. It means that it was subject to taxation because it recognized its economic value.