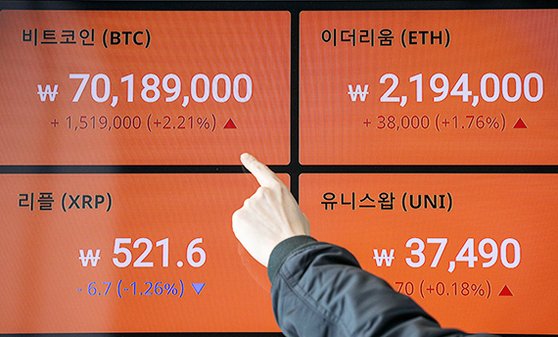

![On the morning of the 14th, the prices of cryptocurrencies such as bitcoin are displayed on the market board of Bithumb Gangnam Customer Center in Seoul. [뉴시스]](https://i0.wp.com/pds.joins.com/news/component/htmlphoto_mmdata/202103/15/8e8c7213-5e66-4420-a0e3-04d9b5ab9598.jpg?w=560&ssl=1)

On the morning of the 14th, the prices of cryptocurrencies such as bitcoin are displayed on the market board of Bithumb Gangnam Customer Center in Seoul. [뉴시스]

The bitcoin value exceeded 71 million won for the first time. The daily transaction amount at four domestic cryptocurrency exchanges exceeded the daily transaction amount in the KOSDAQ market operated by the Korean Exchange.

Domestic daily transaction amount 1.46 trillion

Overtake KOSDAQ, close to 16 trillion KOSPI

According to the cryptocurrency exchange Upbit, as of 1:40 pm on the 14th, bitcoins were traded at 70,994,000 won per piece. Bitcoin exceeded 70 million won at 5:24 am on the same day, and then exceeded 71 million won at 8:45 am. According to CoinMarketCap, an American cryptocurrency market site, on the 13th at 8:49 pm (local time), the price of bitcoin exceeded $60,000 for the first time. It’s been a week since it surpassed 50,000 dollars on the 6th.

According to CoinMarketCap, as of 12 p.m. on the 14th, the last 24-hour transaction amount of four domestic cryptocurrency exchanges (Upbit, Bithumb, Coinone, and Kobit) was 14.66 trillion won. As of this month, it surpassed the average daily transaction amount (11,4126 billion won) in the KOSDAQ market. It was less than 2 trillion won compared to the average daily transaction amount of the KOSPI market (16,459 billion won). However, it should be considered that the regular trading hours of the KOSPI and KOSDAQ markets are 6 hours and 30 minutes a day (9:00 am to 3:30 pm).

Last week, the US Congress passed a $1.9 trillion stimulus package that fueled the bitcoin investment. There are observations that investors, who predicted that inflation (inflation) pressure would increase as liquidity became abundant in the market, began to buy bitcoin called’digital gold’. Usually, when inflation occurs, the price of money falls and the value of real assets rises. Traditional investors have invested in gold to avoid the risk of inflation, but recently cryptocurrencies such as bitcoin are attracting attention as an asset to replace gold.

However, since cryptocurrency prices are highly volatile, investors need to be careful. The Nippon Geizai newspaper said, “Since the end of last year, the price of bitcoin has approximately doubled,” and “the speculative transaction is also overheating.”

Reporter Yoon Sang-eon [email protected]

![]()