|

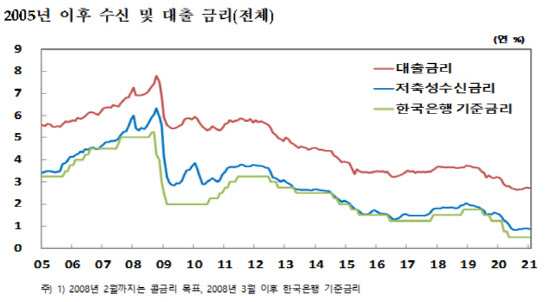

According to the BOK’s’weighted average interest rate for financial institutions in January 2021′ on the 26th, the average loan interest rate based on the amount of new treatment last month was 2.72% per year, down 0.02 percentage points from last December (2.74% per year).

During the same period, both the COFIX (financing cost index) and bank bond interest rates, which are the standard for variable mortgage interest rates, also fell. COPIX’s interest rate fell by 0.04% point from 0.90% per year to 0.86%, and 3-month bank bonds (AAA) and 1-year bonds also fell by 0.01% point. It fell by 0.05 percentage points.

However, the weighted average interest rate for household loans based on the amount of new treatment rose to 2.79% in December from a record low of 2.55% in August last year, and continued on the rise in January. Last month, the household loan interest rate rose by 0.04 percentage points to 2.83% per year. This is the highest level since April last year (2.89% per year). As for the growth rate, it rose to the highest level after an increase of 0.09 percentage points in November 2019.

Looking at the fluctuations in the interest rate of household loans by collateral, general credit loans fell by 0.04% points, microloans fell by 0.19% points, and deposit and savings mortgage loans fell by 0.03% points, but mortgage loans (0.04% points) and group loans (0.14% points). Rose. The mortgage interest rate is the highest since July 2019 at 2.64% per year. The increase was also the largest in one year after 0.09% in December 2019.

Song Jae-chang, manager of the financial statistics team at the Economic Statistics Bureau, said, “Although the interest rates for Cofix and bank bonds fell, the Bogeumjari Loan rate rose 0.10% points from 2.15% per year in December to 2.25% per year in January. Said.

“The results of January loan interest rates do not reflect the drop in January’s COPIX interest rate. As the December and November COPIX rates are reflected, it takes about a month or two for the loan rate to fall.” Explained.

Conversely, corporate loans fell 0.04 percentage points over the same period to 2.69% per year. This is the lowest level since the annual record of 2.68% in October last year. The fact that it recorded the lowest interest rate ever, centered on lending to large corporations, was key. Large corporate loans fell 0.10 percentage points last month to 2.41% per year, the lowest level since the related statistics were compiled in January 1996. However, SMEs increased by 0.01 percentage points. This is because the proportion of loans at high interest rates by some banks has increased, with the proportion of over 3.5% of loans to SMEs increased from 17.8% in December to 18.7% last month.

On the other hand, the deposit bank’s savings-type interest rate (weighted average, based on new treatment amount) fell by 0.05% point, mainly for periodic deposits, and market-type financial products fell by 0.01% point, so the average savings-type interest rate fell by 0.03% point from the previous month. Showed. This is the lowest since August last year (0.81% per year).

The difference in interest rates on deposits based on the amount of new banks handled was 1.85 percentage points, up 0.01 percentage points from the previous month. The balance-based deposit interest rate difference related to the profitability of banks also increased by 0.02 percentage points to 2.07 percentage points.