Banks are raising interest rates for cheonsei loans by lowering preferential interest rates. Banks explain that they inevitably raised the’loan threshold’ in response to the financial authorities’ demand to curb the rise in household loans. However, not a few point out that it only raises the interest burden of ordinary people in that there are many homeless people among users of jeonse loans. As the market interest rate is on the rise recently, there is also an expectation that the rate of transfer from generation to generation will rise further.

○ The real interest rate jumps as the preferential treatment is eliminated.

According to the financial sector on the 23rd, Woori Bank decided to lower the preferential interest rate to 0.2 percentage points, half of the existing 0.4 percentage points, starting on the 25th implementation of’Woori Jeonse Loan’, a representative jeonse loan. This means that if a financial consumer meets various conditions such as opening a salary passbook and automatic transfer, the amount of interest rate that was reduced will be reduced.

Banks set the loan-to-debit rate based on the cost of financing, such as COFIX (COFIX, financing cost index) and one-year financial bonds. The bank’s loan-to-debit rate (based on its own credit rating 3rd grade and two-year temporary repayment variable rate) has risen from 2.06% per annum at the end of July last year when Cofix was at the lowest level of the year based on the new handling amount, to 2.47% per annum as of this day. Climbed. Even if an existing borrower extends the contract, the preferential interest rate benefits disappear and the real interest rate rises.

Woori Bank is not the only one that has lowered the preferential interest rate for loans from households. Nonghyup Bank has lowered the preferential interest rates for housing-related loans, including loans from whole households, by 0.3 percentage points and 0.2 percentage points, respectively, from the 8th and the Shinhan Bank from the 5th. When a bank’s interest rate rises, a’balloon effect’ appears in which demand for loans to be transferred to banks with relatively low interest rates is concentrated. It is analyzed that demand has concentrated on Woori Bank, which had a relatively low interest rate as the interest rates of Shinhan Bank and Nonghyup Banks recently rose, and Woori Bank had no choice but to “adjust the speed”.

○ As the total price rises, the interest burden also increases.

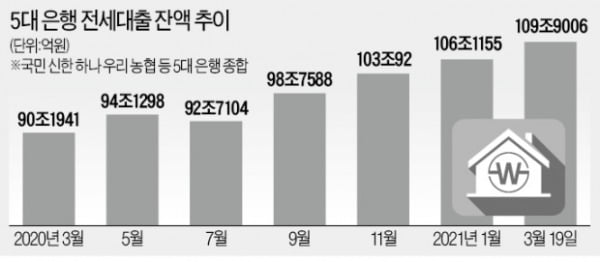

The previous day, the Financial Supervisory Service called in household loan managers from several banks to check the status of loans to households and mortgage loans. This is due to the judgment that the recent increase in jeonse is too fast. On the 19th, the total amount of loans for cheonsei loans from five major banks, including Kookmin Shinhan Hana and Woori Nonghyup, was KRW 10.99 trillion, an increase of KRW 3.78 trillion from the end of January. It has increased by 20 trillion won in the last year. It is analyzed that this is because the house price, which rose significantly last year, boosted the jeonse price, and the amount of individual loans by new contractors increased. This is why banks have recently started to adjust the rate of out-of-generation loans by reducing preferential interest rates.

It is also controversial that the financial authorities manage all household loans by including them in the total amount of household loans along with mortgage loans and credit loans. An official from a bank pointed out that “Chonseed loans have a strong nature of guaranteed loans, so the risk is relatively low compared to credit loans.”

Regarding the bank’s lending rate hike, the FSS is “strengthening monitoring,” and has never ordered the bank to adjust the interest rate directly. There is an opinion that it is necessary to manage the house price as it raises the house price when the scale of renting out increases, and there is an opinion that it only raises the interest burden of the common people in a situation where the property price has risen due to the failure of the current government’s real estate policy.

There are also many prospects that the rate of transfer from generation to generation will increase. This is because inflation pressure is raising market interest rates. The interest rate based on a 1-year bank bond, which banks use as a loan indicator, was 0.89% per year on the same day, up 0.05 percentage points from the end of last month (0.84% per year). Financial Supervisory Commissioner Yoon Seok-heon said at the executive meeting on the day, “There is uncertainty about whether the (market) interest rate will continue to rise, but the risk factors must be closely examined.” “In particular, due to the high proportion of variable rate loans, many borrowers are exposed to the risk of rising interest rates.”

Reporter Daehoon Kim/Hyunah Oh [email protected]

Ⓒ Hankyung.com prohibits unauthorized reproduction and redistribution