Excluding 430,000 households nationwide due to this increase in public price.

Lowered the upper limit for detailed charges, but effective against various VAT’similar’

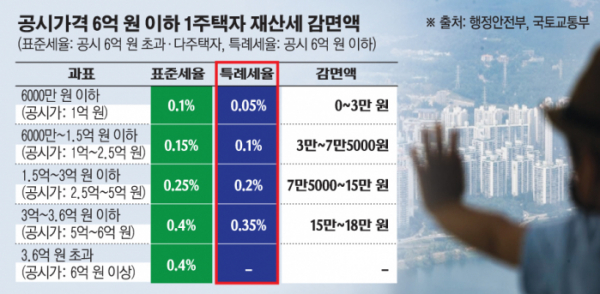

(Graphic = Reporter Son Mi-kyung sssmk@)

This year, complaints about the home ownership tax (property tax + comprehensive real estate tax) are growing. This is because there is a high possibility that the ownership tax will increase significantly as the government significantly raised the publicly priced apartment prices this year. In Seoul, which has been a target of raising the public price, the government’s promise of reducing property taxes on mid- and low-priced homes is only contemplating.

According to the Ministry of Land, Infrastructure and Transport, among the nationwide apartment houses, about 1.11 million houses with an official price of more than 600 million won this year. Compared to last year, when there were less than 690,000 households, it increased by 430,000 households. The share of houses with a public price of 600 million won or more in total apartments also increased from 4.9% to 7.9%. In Seoul, the rate of increase was faster, and the share of apartment houses with more than 600 million won from 20.8% last year increased from 20.8% (520,000 households) to 29.8% (750,000 households).

A similar phenomenon emerged when considering the proportion of homes with more than 900 million won that the government classifies as expensive homes. The proportion of apartment houses in the country with a publicly announced price of 900 million won or more increased from 2.2% (310,000 households) to 3.7% (520,000 households) last year, and from 11.1% (280,000 households) to 16.0% (410,000 households) in Seoul. . This is because the government is raising the quoted price in line with the market, saying that it will increase tax equity and the credibility of the quoted price. The national average rate of increase alone is 19.1%, the largest increase in 14 years.

The published price serves as a taxable standard for leviing home ownership taxes, such as property tax and comprehensive real estate tax (deposit tax). When the public price increases, the burden of home ownership tax also increases. Previously, the publicly announced price of 900 million won, which was the standard for imposing the final tax, was evaluated as an important criterion for determining housing prices. Starting this year, the official price of 600 million won, which is the standard for property tax reduction, has become a boundary between homeowners’ happiness.

Initially, the government decided to raise the public price realization rate (market price reflection rate) to 90% by 2035, and to temporarily reduce property tax. According to the government’s special taxation system, the property tax rate is reduced by up to 0.05 percentage points for three years for one-homeowners who have a house with an official price of 600 million won or less. In the case of a house with an official price of 600 million won, the ownership tax burden is reduced by 210,000 won from about 1.47 million won to 1.26 million won.

The problem is that as the publicly priced increases, apartments that were subject to property tax reduction until last year have become inaccessible in many cases. In particular, this year, as the publicly priced realization work, which had been carried out in the Gangnam area of Seoul, was expanded to middle and low-priced houses in the Gangbuk area, houses that were eliminated from the property tax reduction object one after another. In the so-called’Nodo River’ (Nowon, Dobong, Gangbuk-gu) and’Geumgwan-gu’ (Geumcheon, Gwanak, Guro-gu), which were so-called residential areas for the common people, the rate of increase in the publicly listed apartment prices reached an average of 20-30% this year, surpassing the Gangnam area.

In some apartments, the published price has risen by nearly 50% this year alone. The 115㎡ type dedicated to life apartments in Junggye-dong, Nowon-gu, Seoul, was subject to property tax reduction since the official price was 535 million won last year, but the official price this year was set at 796 million won, an increase of 49.0%. As the publicly priced soared, the ownership tax burden owed to the owner of this apartment rises from 1.22 million won last year to 2.2 million won this year. If this trend is the case, we have to worry that we will be subject to the taxation next year.

In order to prevent a surge in the tax burden, the government applied a special tax rate retroactively to houses owned by homeowners, whose official price was less than KRW 600 million last year, and lowered the upper limit of tax burden (the line that prevents the increase of the ownership tax beyond a certain range from the previous year’s possession tax burden). But it doesn’t have a big effect. This is because, as the public price increases, various additional taxes attached to the ownership tax, such as the local education tax and the special tax for farming and fishing villages, also increase.

In a situation where the number of such households has increased rapidly, mainly in large cities, tax provisions are bound to arise. There is already a group objection movement in the apartment complex community. Front-line local governments such as Jeju and Seocho-gu, Seoul are also confronting the central government by demanding a freeze of the official housing prices. In the real estate industry, tax resistance is expected to spread until June, when property taxes and taxation taxes are finalized.

Seo Jin-hyung, president of the Korean Real Estate Association (Professor of Kyungin Women’s University) said, “If the publicly priced housing price rises and the ownership tax increases, the burden can be passed on to the tenant. There is a risk that the housing sale price will rise in line with the jumped publicly announced price.”