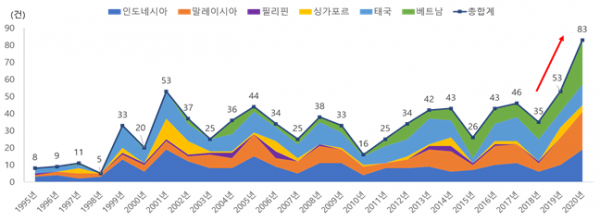

83 new trade relief cases targeting ASEAN countries from January to October last year,’the highest ever’

▲ Trends in new surveys on import regulations in ASEAN countries (Photo Credit=Trade Association)

As import regulations surrounding ASEAN appeared to have been newly established last year, a suggestion was made that it was necessary to prepare for Korean companies that entered the country.

According to the report “Export and Investment Enterprise Risk Based on ASEAN’s Trade Remedy Status” released on the 13th by the Institute for International Trade of the Korea International Trade Association, the ASEAN region has emerged as a production base and consumption market replacing China after the US-China trade dispute. . Accordingly, the number of newly launched trade remedy measures targeting ASEAN countries by advanced countries recorded 83 cases from January to October last year, the highest ever.

By country, △India (24 cases), △United States (17 cases), △Australia (8 cases), △Canada (5 cases). The US and the European Union (EU) are actively investigating attempts to bypass trade relief measures by assembling, completing and exporting products in ASEAN.

The report advised that “Korean companies that have entered ASEAN should also prepare in advance for the risk of becoming a subject of investigation when establishing business plans and procurement plans for raw materials and parts.”

▲ Trends in new surveys on import regulations in the ASEAN countries (Photo Credit=Trade Association)

At the same time, ASEAN countries’ protective trade measures are also being strengthened. From January to November last year, there were 48 new investigations on trade relief measures such as anti-dumping led by ASEAN countries, the highest since 2012 (33).

Not only has the number of cases increased, but the trade relief system is being operated in various ways by country. Thailand and Vietnam initiated bypass investigations in 2020 and 2018, respectively, and Vietnam also initiated countervailing tariff investigations for the first time in the ASEAN region in September last year. Cambodia and Laos also revised related regulations from 2017 and introduced a trade relief system, and in Myanmar, the import protection law, including the trade relief clause, came into effect on July 1 of this year.

The report said, “In the case of Vietnam, Korea’s largest investment destination and third-largest export country, the US considers it a non-market economy, so it is highly likely to be imposed higher anti-dumping tariffs than market economies.” Intensive import regulatory measures, such as deciding on a subsidy that can be offset against the devaluation of the exchange rate in Vietnam, are continuing.

Kim Gyeong-hwa, a senior researcher at the International Trade Association, said, “It is essential for Korean companies to properly understand the current status of the ASEAN trade remedy at home and abroad in order to be able to use the ASEAN market as a high-potential consumer and production base.”