|

According to a report on the International Financial Center’s “Taper Tantrum vs Inflation Tantrum” on the 12th, concerns about monetary tightening can be mitigated by responding to policies by the U.S. Federal Reserve System (Fed). Seizures) are likely to become frequent.

Tapered tentrum means that investors suddenly withdraw funds from the market shock caused by tapering (reduced asset purchases), causing seizures such as a sharp decline in the value of currencies and stock markets in emerging countries. “If the Fed fails to adjust between the new policy objectives and market perception, there is a concern that interest rate volatility will increase further, coupled with a decrease in the depth of the government bond market,” the KTB Center said in a report.

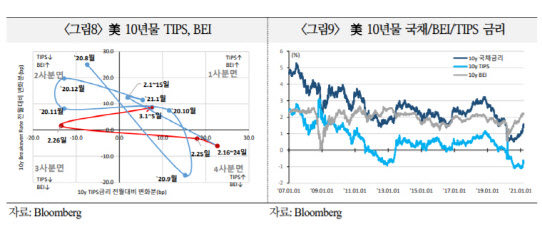

Starting this year, the 10-year Treasury bond yield, which serves as a market benchmark, has soared from less than 1% earlier this year to more than 1.6% recently. On the 25th of last month, it surged over 0.15 percentage points, exceeding 1.5% per annum. On the 8th, the interest rate jumped to the 1.6% level based on the closing price, then rose 1.5% in the early mid-range. It is similar to the tapered tantrum period 8 years ago in that the rate of interest rate rise has accelerated and the cause has changed from expected inflation to real interest rates during the economic recovery phase of reflation. Reflation means trying to recover the economy by allowing inflation to rise to some extent, not in the stage of severe inflation, out of deflation (recession caused by inflation).

|

However, there are differences in the monetary policy system and stage, fiscal policy and the strength of the economic recovery. In order to cope with the shock and impact of Corona 19, while maintaining the stance of monetary easing, concerns over inflation due to the acceleration of the economic recovery and uncertainty in the new monetary policy system are leading to a rise in interest rates.

Researchers Seong-taek Kim, Seo-hee Hong, and Won-jung Hwang commented, “Until last January, the rise in the expected inflation rate (BEI) in line with the prospect of accelerating the economic recovery in the US led to the rise in interest rates. “The nominal interest rate (10-year Treasury bond interest rate) led to the rise,” he analyzed.

In the future, even if the Fed emphasizes an easing stance, the market will continue to reflect concerns that it will be forced to austerity depending on inflation and growth indicators. The 10-year inflation-linked government bond (TIPS) interest rate, a representative real interest rate indicator, rose from -1% earlier this year to -0.62% on the 8th (local time).

“As Fed Chair Jerome Powell mentioned, we expect to maintain the easing monetary policy stance until conditions such as achieving maximum employment, reaching 2% inflation, and maintaining the 2% level in inflation for a considerable period of time,” said the National Finance Center. “1 As until May, the rise in interest rates arising from an increase in expected inflation will remain stable up to a certain level, but if the financial conditions deteriorate due to a rise in real interest rates, we will respond promptly.”

In its report, “Checking the possibility of inflation spikes in April and May”, which analyzed the possibility of US inflation by scenario, “The explosive demand from the base effect and excess savings from the plunge in inflation a year ago, and the premature end of the pandemic. And, assuming inflation from the supply side, the consumer price index (CPI) rise temporarily exceeds 4%, and inflation spikes cannot be ruled out.”

|