Suspension of credit loans from Samsung, Mirae Asset, and Daeshin

On the 14th, accounts receivable 5602 billion won, counter trading 387 billion won

Credit transaction loans exceeded 21 trillion won. It is the largest in the KOSPI and KOSDAQ markets combined.

According to the Financial Investment Association, the amount of credit loans increased to 11 trillion won in KOSPI and 10 trillion won in KOSDAQ on the 14th. This is an increase of nearly 5 trillion won in two months from the total size of 16 trillion won in November last year.

Securities companies are halting new loans one after another to manage their loan balance and manage customer risk. This is because the total amount of credit grants must not exceed 100% of equity capital.

Samsung Securities has halted credit loans including purchases of credit loans from the 13th. Currently, Samsung Securities only supports loans secured for sale.

Mirae Asset Daewoo announced on the 15th that it will temporarily suspend new loans for securities mortgage loans until the 20th to manage the credit limit. Includes pension type, plus loan, and unpaid automatic mortgage loan. However, it is possible to buy and sell credit loans, sell-to-sell loans, and micro-automatic loans, and extend the maturity of existing loans if conditions are met.

Daishin Securities also announced to investors that it will stop credit loans from the 18th. As the credit balance increases, it is highly likely that other securities companies such as KB Securities and Korea Investment & Securities will also suspend their credit loans.

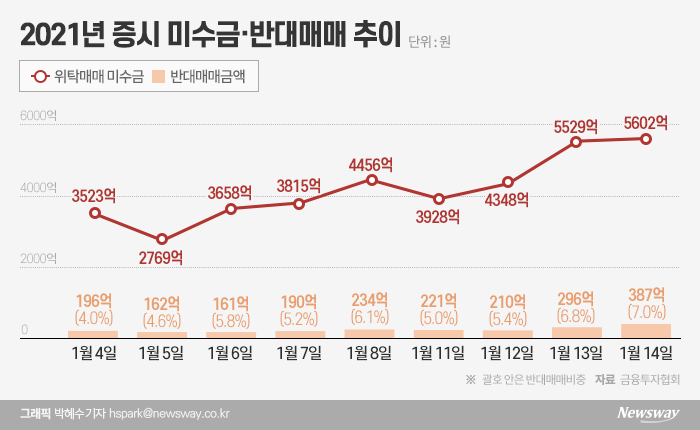

The amount receivable is also increasing rapidly. On the 4th, accounts receivable from consignment sales of 3522 billion won increased 59.06% to 5602 billion won in 8 trading days on the 14th.

Investors may suffer a huge loss because unacceptable transactions are subject to counter trading as much as the amount of margin shortfall if they cannot be liquidated within 3 days due to a decline in stock prices.

In fact, the proportion of counter-trading compared to accounts receivable, which was around 4% on the 4th, soared to 7% on the 14th. The amount is 38.8 billion won.

Bank credit loans are also gradually raising the threshold. According to the banking sector, the credit balance of KB, Shinhan, Hana, Woori, and NH Nonghyup five major commercial banks as of the 14th was estimated at 136 trillion won.

Banks are wary of credit loan funds being used for stocks. This is because concerns over overheating in debt are growing. Since the 15th, Shinhan Bank has lowered the maximum limit of 4 credit loan products for office workers by 50 million won. However, the maximum limit for negative bankbook loans was maintained at 100 million won.

Other banks are known to be reviewing credit restrictions from early this week. Meanwhile, the total balance of term deposits at the five major banks was 631 trillion won as of the 14th, down nearly 10 trillion won from the end of October last year.

The interpretation of the financial sector is that it is evidence that commercial funds are being turned to stocks.

Reporter Cho Eun-bi goodrain@

<저작권자 © 온라인 경제미디어 뉴스웨이·무단 전재 및 재배포 금지>