“Education of children and marriage after retirement need 170 million… Retirement benefits are less than 100 million”

Insurance Development Institute’s Retirement Market Report… 4050 households “retired couples need at least 2.27 million won per month”

67% of the elderly “No one to receive money”

(Seoul = Yonhap News) Reporter Ha Chae-rim = After retirement, the 40s and 50s expect to spend an average of nearly 200 million won on children’s education and marriage, but the retirement benefit is less than 100 million won.

Retirees are hit hard by declining income, but two out of three senior citizens have no financial help.

The Korea Insurance Development Institute published the ‘2020 KIDI Retirement Market Report’ on the 11th, which was analyzed based on statistics from outside agencies such as the National Statistical Office and the National Pension Service, as well as the two-year retirement market survey (2019).

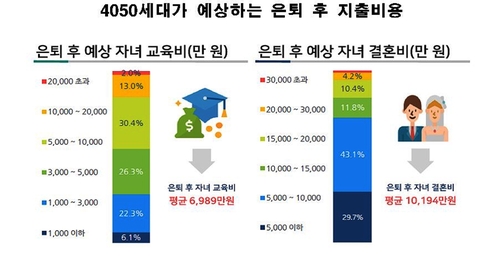

In a survey on the retirement market, people in their 40s and 50s in the metropolitan area and metropolitan cities predicted significant expenditures for their children’s education and marriage after retirement.

Expected children’s education expenses on average were 69.89 million won, and expected children’s marriage expenses were on average 119.4 million won. 15.0% of respondents expected more than 100 million won for their children’s education, and 15.4% expected more than 150 million won for marriage.

However, the average retirement benefit expected by 4050 households was 9466 million won, which was not enough to pay for children’s education and marriage expenses.

They answered that the’minimum living cost’ required for retirement was an average of 2.27 million won for a couple and 1.3 million won per person. The’appropriate living expenses’ averaged 3.12 million won for a couple and 1.38 million won per person.

According to data from Statistics Korea’s ‘2019 Household Financial Welfare Survey’, household income (earned income, business income, property income, and transfer income) decreased from an average of 62.5 million won before retirement to 27.8 million won after retirement. Income after retirement is tight even for the couple’s minimum living expenses.

The 4050 generations cited economic difficulties (31.1%) most as the disadvantage of retirement, followed by deterioration in health and disability (17.1%), and boredom (16.5%).

◇ “Public pension, 21% of pre-retirement income…Private pension tax benefits should be increased”

After retirement, the relationship to receive financial help in the event of an emergency was also weak.

According to Statistics Korea’s ‘2019 Social Survey’ data, most of the elderly over 65 years old have’someone to ask for housework because they are sick’ (74.5%) and’someone to talk to when they are depressed’ (72.6%), but’people who can get financial help There is only 33.4% of the answer.

The replacement rate for the recipients of the national pension (old-age pension) was estimated to be 21.3%, so the national pension alone was not enough to maintain a stable retirement life. The income replacement rate refers to the ratio of pension receipts to income during economic activity.

The 4050 households own 53.3% of the total household assets in Korea, but the asset is concentrated in the real (75%) and more than 90% of the real assets are’confiscated’ in real estate, which can lead to liquidity restrictions in retirement. Analyzed.

In the Household Financial Welfare Survey, as many as 23.8% of households in the fifth quintile (the highest) of retired households (household owners) answered that their living expenses were insufficient (‘shortage’ or’very short’). 10.6% of households in the quintile of income felt a lack of living expenses.

Accordingly, the elderly also showed a tendency to maintain employment status as long as there were no health problems due to lack of income or other reasons. According to the data of the 7th National Pension Service Panel Survey by the National Pension Service, 52.8% of those in their 60s were employed.

The Korea Insurance Development Institute said, “Even after retirement, there are many expected expenditures, but retirement benefits alone are insufficient, and public pensions alone are insufficient to prepare for retirement.” There is a need,” he advised.

[email protected]

(End)

<저작권자(c) 연합뉴스, 무단 전재-재배포 금지>

Copyrightⓒ Korea Economic Daily TV. All Rights Reserved. Unauthorized reproduction and redistribution prohibited