Until now, the non-life insurance industry has been complaining about a deficit due to the rising loss ratio of auto insurance. However, entering this year, due to the decrease in the car accident rate due to the spread of Corona 19, there was seldom a voice to raise premiums. As the loss ratio fell somewhat, it was judged that it was not an environment that could demand an increase in insurance premiums.

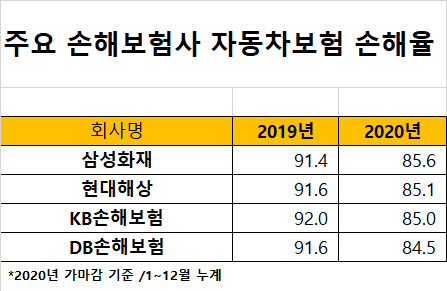

In fact, the loss ratio of the top four non-life insurers (Samsung, Hyundai, DB, and KB) fell slightly. Last year’s loss ratio (the ratio of insurance premiums to premium income) was 84.5~85.6%, which is 7 percentage points lower than the 2019 loss ratio (91.4~92%). Insurance companies are still unable to escape the deficit, but there were also many eyes on whether the situation had improved.

In January every year, the Insurance Development Institute, which had been busily due to requests from non-life insurers to verify auto insurance premium rates, also became quiet. Non-life insurers did not even request verification this time.

|

However, it is predicted that auto insurance premiums will rise as the actual loss insurance premiums rise sharply. Increasing auto insurance premiums was a major challenge in the non-life insurance industry along with an increase in actual loss insurance premiums. Jeong Ji-won, head of the Non-life Insurance Association, who took office in December of last year, also cited’improvement of real-life insurance and auto insurance’ as one of the major inauguration tasks.

There are also concerns that the auto insurance loss ratio may rise again if Corona 19 calms down. An official from the insurance industry said, “It is true that the loss ratio fell last year, but it is only a temporary effect due to the Corona 19 situation.”

Another insurance industry official said, “What insurers fear is the post-disaster situation,” and said, “As insurance premium claims that have been postponed so far, there is a high possibility that expenses will increase from the standpoint of insurance companies.”

As the auto maintenance industry has recently proposed an 8% increase in maintenance fees, the pressure on non-life insurers is increasing.

On the 5th of last month, the Automobile Insurance Maintenance Association issued a proposal to the Ministry of Land, Infrastructure and Transport to increase the number of maintenance by 8.2%. In the meantime, it is argued that the price should be raised to reflect the rise in labor costs.

Meanwhile, the non-life insurance industry is demanding system improvement to prevent over-treatment. Currently, even in the case of minor injured patients, it is possible to treat without any objective evidence and only subjective symptom complaints without limitation of duration and amount.

Jeong Ji-won, chairman of the Non-life Insurance Association, said, “We will prepare and support standards for treatment and compensation for minor accidents in cooperation with the relevant authorities.”

For example, in the case of a patch, one prescription can be prescribed for 10 days, and the number of prescription days is shortened.