|

| Ministry of Trade, Industry and Energy Investment Policy Officer Park Jung-wook is presenting the ‘2020 FDI Trends’ at the briefing room of the Government Complex Sejong on the 12th. 2021.1.12/News1 © News1 Reporter Jang Soo-young |

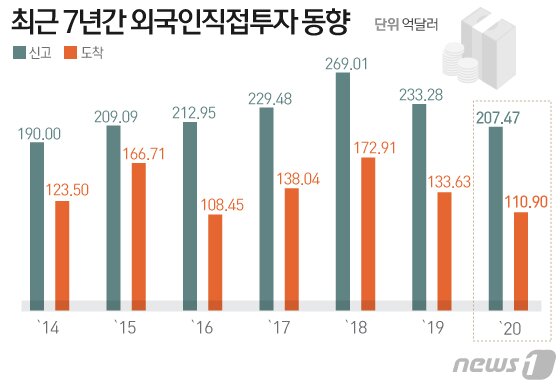

Last year, foreign direct investment (FDI) was found to have stagnated under the influence of a novel coronavirus infection (Corona 19). However, in contrast to the rapid decline in the first half of the year, the rapid recovery in the second half reached 20 billion dollars for the sixth consecutive year.

The Ministry of Trade, Industry and Energy announced on the 12th that FDI in 2020 was $2.75 billion as of filing and $11.09 billion as of arrival, respectively, down 11.1% and 17.0% from the previous year.

Both report and arrival standards are the lowest in the past six years. However, considering the fact that it was hit hard in the first half of the year due to the impact of Corona 19, it is a meaningful number to exceed 20 billion dollars in reporting standards.

In fact, the FDI in the first half of last year was only $7.66 billion as of report and $4.93 billion on arrival, respectively, falling 22.4% and 20.3% compared to the previous year.

In the second half of the year, the decline has greatly eased thanks to strategic attraction efforts through K-Defense and online IR. In particular, in the case of the third quarter, it recorded the highest performance in the third quarter ($5.226 billion), an increase of 44.6% compared to the previous year, and the cumulative rate succeeded in turning into a’plus’. However, in the fourth quarter, the base effect of the fourth quarter of the previous year and the re-proliferation of the corona again decreased by 20.2%.

As a result, FDI for the second half of the year was $13.90 billion on a report basis and $6.16 billion on arrival, down 2.8% and 14.1% from the previous year, respectively.

Last year, the global FDI declined significantly due to the global epidemic and re-proliferation of Corona 19. Global FDI in the first half of last year decreased by 49% compared to the same period last year. Among them, it is an analysis that Korea has successfully attracted FDI of 20 billion dollars for six consecutive years and has confirmed that it is a safe investment destination.

In FDI last year, investment in new industries related to the Fourth Industrial Revolution increased, and the cutting-edge subsidiary sector for securing advanced technology and stable supply turned to increase in the second half. In addition, investment in the green new deal for a carbon-neutral society has also expanded.

Accordingly, the scale and proportion of investments based on reporting standards for new industries related to the 4th industrial revolution such as artificial intelligence (AI), big data, cloud, eco-friendly vehicles, and biotechnology have all increased. The FDI of the new industry was $8.42 billion, an increase of 9.3% from the previous year, and the proportion increased from 33% in 2019 to 40.6% last year.

In addition, investments in cutting-edge materials, parts, and equipment such as semiconductors, secondary batteries, and eco-friendly car parts continued, contributing to responding to Japanese export regulations and localizing high-tech technologies. In particular, FDI in the field of small managers, which plunged 43.7% from the previous year in the first half of the year, increased 30.9% from the previous year in the second half, easing the decline from the previous year.

In addition, foreign investment has contributed to the transformation of an eco-friendly and low-carbon society by increasing investments to expand infrastructure and services in the field of renewable energy and resource recycling. FDI in the fields related to renewable energy such as wind power and solar power and green industry such as water treatment and resource recycling was $480 million, more than doubled from the previous year.

By region, FDI in Greater China (China, Hong Kong, Singapore, Taiwan, and Malaysia) accounted for the largest share of reported $5.46 billion and arrival of $2.94 billion. Compared to the previous year, the performance was good, up 26.5% and 34.4%, respectively. In Greater China, FDI was active in manufacturing and service industries.

|

| © News1 Designer Ilhwan Kim |

Except for Greater China, most other regions showed a decrease compared to the previous year. US reported $5.3 billion (-22.5%), arriving $910 million (-34.5%), European Union (including EU and UK) reported $4.72 billion (-33.8%), arriving $3.78 billion (-47%), and Japan reported $730 million and arrived $500 million, showing a nearly half decline compared to the previous year.

In addition, since August of last year, the Foreign Investment Promotion Act, which recognizes undisposable retained earnings as FDI, has produced considerable results. “A total of 7 investments have been made since the revision,” said Park Jung-wook, the investment policy officer of the Ministry of Industry, and all 7 were investments in the green field (a method of investing by establishing a production facility or corporation directly). I think it was done.”

However, the FDI outlook for this year is not bright. The United Nations Council on Trade and Development (UNCTAD) predicts that this year’s global FDI will decline by 5-10% and will recover after 2022. In particular, as uncertainties about the global economy increase, such as the prolonged economic recession due to the re-proliferation of Corona 19, the launch of a new government in the United States, and the realization of Brexit in the UK, it is expected that global investors’ investment sentiment will continue to contract for the time being.

Accordingly, the domestic situation is also not easy. It is because there are positive factors such as stable investment location recognition, FTA network, and high external credit rating according to K-Defense, but negative factors such as Corona 19 and competition for technology supremacy between the US and China still exist.

Investment Policy Officer Park Jung-wook said, “We plan to promote various measures such as setting strategic targets such as customized incentives, fostering high-tech industrial clusters, and flexible investment attraction activities through online.” We will actively discover and attract investments contributing to the advancement of the industry and strive to achieve a’plus conversion’ of FDI.”