LG Energy Solutions, which was spun off from LG Chem’s battery business division, is starting to go public with IPO. It is expected to be listed as early as the second half of this year. The corporate value alone is expected to be around 100 trillion won, making it the largest in the history of domestic IPOs.

According to the investment banking (IB) industry on the 10th, LG Energy Solutions decided to send a bid proposal (RFP) to major securities companies in the near future to select a listed supervisor. The timing is significantly ahead of what was expected at the end of this year or early next year. After receiving the proposal this month, LG plans to start preparing for the contest after selecting a host company through a presentation (PT).

In the industry, LG Energy Solutions is expected to enter the stock market in the second half of this year as early as possible. If you request a preliminary examination for listing on the Korea Exchange after receiving a designation audit in the first quarter after selecting the organizer, approval can be obtained in the first half. After that, it is possible to list within this year by submitting a stock report.

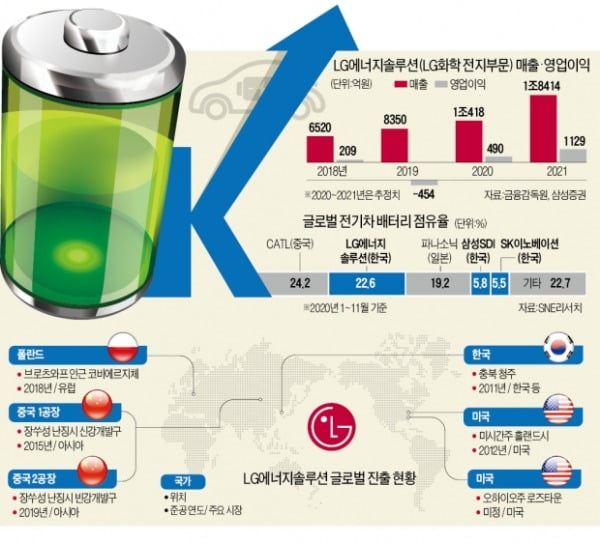

Stock prices estimate the corporate value of LG Energy Solutions at least KRW 50 trillion. As the rechargeable battery industry is showing an ultra-fast growth, it is also analyzed that it will reach a maximum of 100 trillion won. This figure takes into account that the market cap of its rival, China’s largest electric vehicle battery maker CATL, is around 160 trillion won.

An official from the IB industry predicted that “LG Energy Solutions has no choice but to pay attention to the conditions for financing because its public offering reaches several trillion won. “When liquidity in the market overflows and the stock market is good, we will promote listing.”

![[단독] LG Energy Solutions to enter the stock market with'random price of 100 trillion won'](https://i0.wp.com/img.hankyung.com/photo/202101/AA.24961800.1.jpg?w=560&ssl=1)

LG Energy Solution, hasten to charge live ammunition… Take control of the battery’s supremacy

10 trillion procured by IPO… Preemptive investment

LG Energy Solutions decided to go ahead with the schedule and go to IPO. In order to secure the hegemony of the global electric vehicle battery market, it has decided to invest early by raising funds. The IPO schedule is several months ahead of the original market forecast. With the rapid growth of the electric vehicle market and the fierce pursuit of competitors, it was determined that rapid financing was necessary.

LG Energy Solutions decided to expand production bases at the forefront of the electric vehicle market, including the US, Europe, China, and increase investment in R&D with approximately 10 trillion won of funds secured through IPO. The goal is to surpass China’s CATL and leap to the top in the world.

30% increase in battery capacity this year

According to the battery industry on the 10th, LG Energy Solution’s battery production capacity this year is expected to increase by 30% from last year (120GWh) to 156GWh (gigawatt hours). This is the impact of the launch of bold new car models that use LG batteries such as the Tesla’Model Y’produced in China, Volkswagen’ID.4′, and Ford’Mustang Mach-E’. In line with the increasing number of orders, LG Energy Solutions plans to increase its battery production capacity to 260GWh by 2023.

The reason why LG Energy Solutions has started IPO work in a hurry is because it decided that it was urgent to prepare investment resources to achieve the plan. The investment banking (IB) industry is expected to secure more than 10 trillion won in funding through an IPO as it is estimated that the corporate value of LG Energy Solutions will reach a maximum of 100 trillion won.

In the global electric vehicle battery market, LG Energy Solutions is in fierce competition with CATL. According to market research firm SNE Research, CATL ranked first with a 24.2% share in the ranking of battery usage for electric vehicles sold in the world from January to November last year. It surpassed LG Energy Solution (22.6%) by a slight margin. Until October, LG was the number one, but CATL reversed as EV sales in China surged.

In the automobile and battery industry, for the time being, five companies including LG Chem, CATL, Panasonic, SK Innovation, and Samsung SDI are expected to form an oligopoly market, and the fierce battle between LG and CATL, which are’Yanggang’s, will continue. An industry insider said, “The electric vehicle battery industry requires enormous investments in plant expansion to respond to rapidly growing demand, R&D for high-performance product production,” and “K battery companies’ competitiveness ultimately depends on their ability to raise funds.”

Expected rapid growth in the US electric vehicle market

This year’s global battery market is expected to develop favorably for three K-battery companies, including LG Energy Solution, SK Innovation, and Samsung SDI. Following Europe, which dominates the market, the US electric vehicle market is expected to grow rapidly.

Last year, the battery usage of the three domestic companies increased by 143%, 239% and 72%, respectively, compared to the previous year. It outperformed CATL (3.1%) and Panasonic (-8.5%). The European electric vehicle market has benefited from the rapid growth. Last year, sales of electric vehicles in Europe increased to 1.29 million units, about twice as high as the previous year. Europe is a market dominated by domestic companies with only 70% of LG Energy Solutions’ share.

This year, the US electric vehicle market is expected to grow rapidly. U.S. President-elect Joe Biden, who will soon begin his term, has professed to advance the era of electric vehicles. The industry predicts that the US electric vehicle market will grow by more than 40% this year.

Although Tesla’s influence was strong in the US market, competition is expected to intensify this year as automakers such as Volkswagen, Hyundai Motor Company, and Toyota introduce electric vehicle-specific platforms. Ten new electric vehicles are expected to be launched in the US in the first half of this year. An official from the battery industry said, “It is difficult for Chinese companies such as CATL and BYD to enter the US market due to the US-China trade war and strong regulatory influences.” “Panasonic is focusing only on Tesla, which is advantageous for Korean battery companies to expand the market.” He explained.

Reporter Mansu Choi/Yejin Jeon [email protected]