A privately held company whose ransom is soaring ahead of listing on domestic and international IPOs’Jack’

Yanolja, over-the-counter transaction price soared to 6.4 times this year… Curly 79%↑

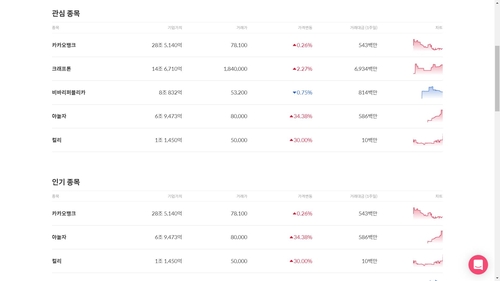

Kakao Bank’s over-the-counter enterprise value of 28 trillion won 14 sets of kraftton

(Seoul = Yonhap News) Reporter Park Jin-hyung = Coupang, SK Bioscience, and other domestic and overseas IPOs have been hitting the box office, so the value of unlisted companies that are about to be listed is soaring in the over-the-counter market.

According to the unlisted stock trading platform’Seoul Exchange Unlisted’ on the 14th, the trading price of Yanolja, a leisure platform company, jumped 6.4 times from the end of last year (12,500 won) to 80,000 won as of the 12th.

In addition, Curley, the operating company of Market Curly, surged 78.6% from 28,000 won at the end of last year to 50,000 won at the end of last year, and Krafton, a game company known as the world’s popular game’Battleground’, also rose 11.5% this year.

Of these, the transaction price of Yanolja and Curly is the highest since the unlisted Seoul Exchange opened for the first time in 2019 and started a pilot service.

Accordingly, the market capitalization based on the transaction price is 6,947.3 billion won for Yanol and 1.14 trillion won for Curley.

Compared to the last month since the end of last year, when the unlisted listing of the Seoul Exchange started official service, Yanolja has increased by about 2.0 times, Kraftton by about 1.9 times, and financial platform Toss operator Viva Republica by about 4.7 times.

Investors who have witnessed the recent IPO box office fever such as Coupang and SK Bioscience appear to flock to preoccupy the stocks of these companies that are about to be listed.

SK Biosciences rewritten the IPO box office record in Korea on the 9th to 10th, absorbing the largest amount of subscription margin ever, of 63,6198 billion won from the public offering stock offer.

Coupang closed the transaction at $48.47 per share on the 12th (local time), the second day of listing on the New York Stock Exchange (NYSE), with a market capitalization of $87.2 billion (about 99.155.1 billion won).

Backed by the success of Coupang’s listing in the US, Curley is also considering listing on the New York Stock Exchange this year, and its corporate value reaches about $880 million (about 1 trillion won), the Wall Street Journal (WSJ) reported.

A non-listed official of the Seoul Exchange said, “The number of monthly active users (MAU) has nearly doubled in about 3 weeks in recent years.” “I explained.

In addition, he added, “In particular, since Curly can only be traded on our platform, there is an explosion of interest in the news of Curly listing promotion.”

In addition, unlisted companies, which are considered the’big fish’ of this year’s IPO market, are also swelling their corporate value as their OTC market prices are soaring.

In the case of Kakao Bank, the corporate value of Kakao Bank was estimated at about 28 trillion won as it traded for an average of 76,000 won on three major unlisted stock trading platforms, including the Seoul Exchange unlisted, Securities Plus unlisted, and 38 Communications.

The average transaction price of Krafton on these platforms was 1.18 million won and the enterprise value was estimated at 14 trillion won.

However, there are some views that investors need attention as unlisted stocks, whose prices have soared over-the-counter due to scarcity, have decreased considerably after the actual listing.

In the case of Big Hit, just before listing last year, it was generally traded at around 300,000 won per share, but since its listing in October last year, its stock price has been in the range of 100,000 to 200,000 won.

[email protected]

(End)

<저작권자(c) 연합뉴스, 무단 전재-재배포 금지>