The amount of money held by selling 1,000 won worth of goods increased by 6 won from 26.4 won in 2019 to 32.4 won in 2020. In particular, the net profit of food and beverages increased by more than 100% thanks to the expansion of medical precision and untact (non-face-to-face), which was in the boom of’K-quarantine’. Operating profit increased by nearly 30% even from the dominance of the overall profits of listed companies.

It is unpredictable this year in a situation where Corona 19 has not completely disappeared. However, in the market, it is predicted that this year’s operating profit will increase more than last year.

|

Sales’duk’ profit↑… Concerns about a recession-type surplus

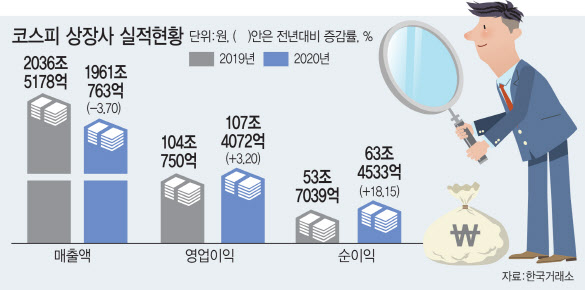

According to the ‘2020 Securities Settlement Performance’ announced by the Korea Exchange and the Korea Listed Companies Association on the 4th, last year’s sales based on consolidated financial statements of 597 companies (excluding 65 companies such as unsuitable audit opinions and spin-off mergers among 662 companies) were 1961. It was down 3.70% from the previous year to 763 trillion won. This is a decrease of 75 trillion 41.5 billion won.

Even though sales declined, profits increased. Operating profit increased by a whopping 3,332.3 billion won (3.20%) to 107,4072 billion won. Net profit surged 18.15% (9,749.4 billion won) to 63,453.3 billion won.

Despite a slight decrease in sales, the reason for the increase in profits was the increase in the operating margin and net margin. Some companies have also benefited from Corona 19, but most companies have tightened their belts, such as cost cuts and restructuring, for fear of worsening market conditions. Rather than earning more, it is a recession-type surplus caused by not using it or not using it.

The operating margin of sales increased by 0.37% from 5.11% to 5.48%, and the net profit margin increased by 0.60% from 2.64% to 3.24%. In 2019, selling 1,000 won worth 26.4 won in hand, but last year 32.4 won. It increased by 6 won from the previous year.

The situation is not very different, except for 12.08% of sales of listed companies. Consolidated sales, excluding Samsung Electronics, fell 4.53%. On the other hand, net profit increased to 15.89%. However, there was a difference in operating profit. Excluding Samsung Electronics, operating profit declines by 6.41%.

This is because Samsung Electronics’ operating profit was greater than that of other listed companies. Samsung Electronics’ operating profit increased 29.62% from 27.76 trillion won in 2019 to 35,993.8 billion won last year.

Anticipation of the global economy for the spread of the corona vaccine↑

This atmosphere is expected to continue this year. Until the beginning of this year, it would be good to have a base effect last year in the first half, but there was a prospect that it could be dark in the second half. However, the situation is changing recently. The travel, hotel, and tourism related industries, which had suffered a recession last year due to the expansion of the corona vaccine, are wriggling with anticipation, and expectations for the construction industry are also increasing due to the government’s policy to expand housing supply.

Unstable global semiconductor supply and demand is leading to sales expectations of domestic semiconductor companies. With the expansion of the electric vehicle industry, automakers and domestic secondary battery companies are also attracting attention. There is also an expectation that the perceived warmth will spread to the whole world with the US Biden administration’s $2.5 trillion in infrastructure stimulus plan.

This expectation is also shown in statistics. According to F&Guide, a financial information analysis company, 150 KOSPI-listed companies are expected to see operating profits of 170 trillion won this year, up 55.7% from last year.

In the first quarter (192 companies), operating profit is estimated to increase by 136.6% from the same period last year to 37,9475 billion won. In particular, Samsung Electronics, which accounts for about one-third of the operating profits of listed companies, is expected to record 8,795.9 billion won in operating profit in the first quarter.

Heo Jae-hwan, a researcher at Eugene Investment & Securities, predicted, “There is a much greater possibility that the economy and corporate profits will improve as the second half goes on.” Lee Kyung-min, a researcher at Daishin Securities, also said, “In the case of Korea’s 2021 earnings per share (EPS) growth rate, it reaches 54%. It is also high compared to global EPS performance (25%). This good thing means that Korean companies are doing well.”

In addition to Samsung Electronics last year, major domestic companies such as the top five in the global market have seen positive changes in various industries. After Coupang’s listing in the U.S., it has also been reevaluated with a Korean company (Naver). Warmth is spreading throughout the industry.

“Up until the beginning of this year, I was wondering if I could do better this year because last year’s performance was better than expected, but the earnings outlook is being revised up very quickly,” he said.