The dominant analysis is that the aftermath of the’game stop incident’, led by individual investors in the United States, inflicting astronomical losses to the short selling forces, also affected the domestic stock market. As the number of individual investors has soared to more than 9 million due to the Donghak Ant Movement, and the possibility of a Korean game stop situation is growing, it is interpreted as a result of active risk avoidance by foreigners and institutions ahead of the resumption of short selling. In addition, there is a view that the possibility of a rapid increase in short selling even after May is low as Donghak ants’ influence on policies and markets has increased and related regulations have been strengthened.

|

Concerns about Korean version of’Game Stop’… Celltrion, short selling balance plunges 1 trillion won

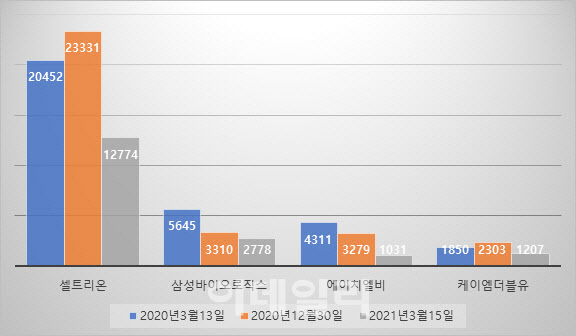

According to the KRX information data system of the Korea Exchange on the 18th, the short selling balance of Celltrion as of the 15th was 1.277.4 billion won, a sharp drop of 1.43 trillion won (45.2%) from the end of the previous year (2.333 trillion won). In addition, the second-largest short selling balance in the KOSPI market declined 16.1% (331.1 billion won → 27.8 billion won) in the short selling balance during the same period.

The short selling balance in the KOSDAQ market declined even more. HLB’s short selling balance during the same period was 68.5% (327.9 billion won → 1031 billion won), 47.6% (2303 billion won → 1207 billion won), 65.5% (282 billion won → 97.2 billion won), and 63.3% (102.3 billion won → 371 billion won). In just three months, the short sale balance was cut in pieces, showing a steep decline.

In particular, Celltrion and KM Double Oil, which are the number ones in short selling balances in the KOSPI and KOSDAQ markets, are sharply decreasing compared to the increase in their short selling balances even during the period of banning short selling last year. These two stocks had short selling balances of KRW 2.45 trillion and KRW 185 billion, respectively, on March 13, 2020, the trading day immediately before the ban on short selling took effect. However, on December 30, the last trading day of the year, after the ban on short selling lasted for more than nine months, it increased by 14.1% and 24.5%, respectively, to 2,333.1 billion won and 2303 billion won.

However, after Jan. 27, when the game stop situation rapidly emerged, the short selling balances of Celltrion and KM Double were 40.5% (2,146.4 billion → 1,277.4 billion), respectively, and 67.1% (3138 billion → 1031 billion). Decreased. During this period, the Korean Stock Investors Association (Hantuyeon), an online community with 44,000 members, declared a’war against short selling’. It is an analysis that the short selling balance decreased.

Foreigners and institutions actively reduce short selling positions… The flow seems to continue after May

In the industry, due to the expansion of Donghak Ant’s influence and the strengthening of related regulations by the financial authorities, there is a low possibility that foreigners and institutions will attempt to short-sell certain stocks in large quantities after May. Donghak ants showed deep-rooted resentment against short selling, and more than 200,000 people agreed to the Cheong Wa Dae public petition, and led to the extension of the ban on short selling twice. As the number of these people has increased to more than 9 million, the influence on the policy direction of the politics and financial authorities has also become strong.

The Financial Services Commission is also planning to implement penalties and criminal penalties for illegal (non-borrowing) short selling from the 6th of next month in accordance with the revision of the Capital Markets Act. Accordingly, in the case of non-borrowing short sale, up to 100% of the short sale order amount, depending on the importance of the violation (upper, middle, and lower), and loan transactions through manual such as messenger and e-mail, within 100 million won if the obligation to store and submit related information is violated. Penalties are imposed. In addition, if the company participates in a paid-in capital increase after short selling of legal borrowings, a penalty of not more than 500 million won or less than 1.5 times the unfair profit will be imposed.

Hwang Se-woon, a researcher at the Capital Market Research Institute, said, “We believe that a similar phenomenon can occur in Korea due to the impact of the game stop incident. It is possible to interpret that institutional investors have actively reduced their short selling positions in some preliminary ways. In view of the current market trend, there is a good chance that the balance will not increase even after the resumption of short selling.”