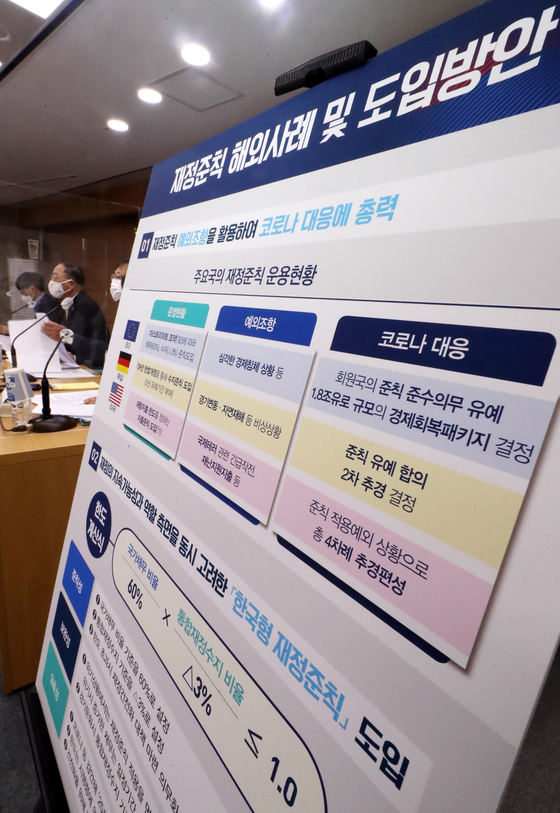

Hong Nam-ki, Deputy Prime Minister of Economy and Ministry of Strategy and Finance, is giving a briefing on the introduction of the’Korean-style fiscal rules’ in the briefing room of the Ministry of Finance of Government Sejong in October last year. News 1

It was analyzed that the ratio of Korea’s national debt to gross domestic product (GDP) will exceed 50% for the first time at the end of this year. It is expected to reach 65% in 2025.

According to data on the International Monetary Fund (IMF) World Economic Outlook on the 7th, Korea’s national debt ratio, which was 40.78% in 2015, will reach 64.96% in 2025. Data from the IMF after 2021 are projections. Specifically, it predicted that the debt ratio would rise from 40.78% in 2015 to 41.92% in 2019 → 48.41% in 2020 → 52.24% in 2021 → 55.8% in 2022 → 59.25% in 2023 → 62.27% in 2024 → 64.96% in 2025. The increase in 2021 compared to 2019 is 10.32 percentage points. In the wake of the novel coronavirus infection (Corona 19), the debt ratio will increase significantly in 2020-2021, when financial expansion is expanded.

Compared to other countries, the increase is remarkable. In the 10 years from 2015 to 2025, Korea’s increase in the national debt ratio is 24.18 percentage points. It is ranked 9th out of 37 developed countries by the IMF classification. Looking at the increase in the share of sovereign debt in developed countries over the same period, San Marino (61.82 percentage points) was the largest, followed by Singapore (34.82 percentage points). Australia (33.2 percentage points), Japan (32.65 percentage points), New Zealand (32.59 percentage points), the United States (32.25 percentage points), the UK (30.05 percentage points), and France (27.73 percentage points).

On the other hand, Spain (19.51 percentage points), Italy (17.29 percentage points), and Canada (15.05 percentage points) have a smaller increase in the national debt ratio than in Korea. The Netherlands (-8.25 percentage points), Germany (-12.66 percentage points), and Portugal (-15.28 percentage points) are expected to see a decrease in the national debt ratio. To overcome Corona 19, the national debt ratio was temporarily increased, but it is planning to promote fiscal consolidation after 2022.

However, the share of short-term funds and foreign ownership of foreign debt is relatively lower than that of developed countries. According to the Ministry of Strategy and Finance’ 2020-2024 National Debt Management Plan, the share of short-term debts with a remaining maturity of less than one year in 2019 was 7.3%. It is below the average of major developed countries (20.4%). The share of national debt held by foreigners (14.1%) is also lower than the average of major countries (25.7%).

Sang-Bong Kim, professor of economics at Hansung University, said, “The increase in national debt is not significant because of the Corona 19 economic crisis, so the rate of increase in Korea is unbearable. Considering the rapidly increasing demand for welfare expenditure in the future, the scale of national debt is rapidly increasing. If it increases, it can lead to a crisis.”

Deputy Prime Minister Hong Nam-ki said several times in the process of discussing with the Party over the provision of emergency disaster support and additional budget (additional budget) last year, saying, “National finance is not a matter of fire.” In a question about the government held at the National Assembly on the 5th, he said, “I agree that the role of the government in the period of Corona 19 is growing and the fiscal needs to expand expansively,” he said. “However, from the position of fiscal balance, the government debt, fiscal soundness issues. I ask you to take into account the position that you cannot but see together.”

Sejong = Reporter Kihwan Kim [email protected]