|

| Coupang Chairman Kim Bum-seok (left) and Softbank Chairman Son Jeong-eui. © News1 |

As Coupang promotes listing on the New York Stock Exchange (NYSE), veiled secrets and new contents are being revealed one after another.

Representative examples include the remuneration of Chairman Kim Bum-suk, the target amount of funds to be raised through the listing of Coupang, the background of the selection of listing in the US to grant differential voting rights, and presentation of last year’s results and future operation plans and vision.

We analyzed the six secrets revealed in the 196-page S-1 form listing report submitted by Coupang while promoting its IPO.

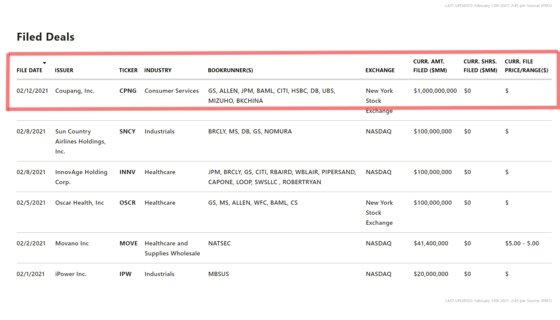

◇ Goal of raising $1 billion, securing funds’breathing’

It was revealed that Coupang plans to raise $1 billion (about 1.1 trillion won) through this listing. If the listing is made, it means that the domestic logistics facilities will be expanded, as well as the real shots necessary for R&D will be secured.

Earlier, Coupang transfused a total of $3 billion (3.3 trillion won) from Softbank twice in 2015 and 2018. This became the driving force behind the establishment of more than 150 distribution centers in 30 cities in Korea.

However, there is a desperate need to secure additional available funds through continuous investment. Liquidity remains depending on the number of stocks to be listed and the range of the offering price, but it is interpreted as suggesting a baseline fund of at least $1 billion.

In the future, it is essential to secure funds as new businesses such as Coupang Itz and Rocket Fresh are expanding and logistics investments continue. In particular, as it has opened the possibility of overseas expansion, it will be able to have room for future plans.

|

| New York Stock Exchange website capture © News1 |

◇ Chairman Son Jeong-eui ‘3.300 billion → 21 trillion’ investment

Softbank Chairman Son Jeong-eui, who has invested an astronomical amount in Coupang, which suffers from deficit every year, is on the verge of a tremendous success, with the principal growing more than six times in six years.

The Wall Street Journal (WSJ) Coupang listing will become the largest foreign company IPO since Alibaba Group in 2014, and predicted that Coupang’s corporate value will reach 50 billion dollars (55 trillion won).

WSJ selected Softbank as the biggest beneficiary of the Coupang listing. The Vision Fund (SVF), an investment fund of Softbank, has a 38% stake in Coupang by investing $3 billion (about $3 trillion) twice in 2015 ($1 billion) and 2018 ($2 billion).

If Coupang’s corporate value reaches $50 billion, SoftBank’s stake in Coupang is expected to reach $19 billion (about 21 trillion won).

The investment capital of 3 billion dollars has increased to 19 billion dollars, and the profit alone is 16 billion dollars (about 1,7212 trillion won).

However, Bloomberg estimates that Coupang’s corporate value is $30 billion (about 33 trillion won) and Coupang internally is estimated to be $40 billion (about 44 trillion won), so Son’s investment margin is expected to differ depending on the size of the enterprise.

|

| Bum-seok Kim, Chairman of Coupang. © News1 |

◇Kim Bum-suk’s salary is 15.8 billion won, and his younger siblings also 800 million won

The remuneration of executives, including Chairman Kim Bum-seok, Coupang, was also confirmed through the listing report.

Chairman Kim last year’s annual salary of about 886,000 dollars (approximately 980 million won) and stock-type bonuses (stock awards. KRW 100 million) was received.

It was found that Chairman Kim’s younger brother and wife also received a total of 800 million won in Coupang. According to Coupang’s stock exchange report, the employment of Chairman Kim’s younger brother and wife was stated as a “employer conflict of interest”.

In a stock exchange report, Coupang explained that “they are not making a living with Chairman Kim,” and that there are low concerns about conflicts of interest. In the United States, the scope of related persons is usually within three villages, including direct relatives, prostitutes, spouses and siblings.

It was found that Chairman Kim’s younger brother received $279,000 to 475,000 dollars per year since 2018, and the younger brother’s wife received $202,000 to 247,000 dollars in the same period. The couple received a maximum of 722,000 dollars (about 800 million won).

Chairman Kim’s younger brother and wife were not included in the list of shareholders with more than 5% stake. However, assuming the corporate value of Coupang as predicted by WSJ, even if the younger brother and the couple own 0.1%, the stake is worth 50 billion won.

Tuan Pam’s Chief Technology Officer (CTO), who was hired last year, collected a total of $27.46 million (30.5 billion won), including stock awards worth $27.43 million. Tuan Pam CTO has been CTO at Uber, a global ride-sharing company, for 7 years.

◇’Nike Curve’, which doubles sales every year, is expected to turn into a surplus

Coupang’s last year’s sales were also revealed. Coupang disclosed its performance through an audit report every April, but when it applied for listing, last year’s management performance was disclosed faster than usual.

Coupang’s last year’s sales amounted to about $11,673.3 million (about $13.25 trillion), up 91% from $6.273.26 million ($7.1 trillion) last year. The operating loss was 52773 million dollars (58.05 billion won), down by about 120 billion won from 64383 million dollars (7082 billion won) in 2019.

Thanks to the benefits of Corona 19 (a novel coronavirus infection), it has doubled its size and has succeeded in reducing the size of the deficit that has been hindered by the calculation of corporate value.

Above all, it is positive that it also showed the possibility of a turnaround. In fact, the deficit is actually reduced to 80.5 billion won, considering that it was not just a simple reduction of the deficit, but an additional 500 billion won in the cost of COVID-19 quarantine.

While the deficit is narrowing, sales are increasing significantly every year. Coupang’s sales, which were only 47.8 billion won in 2013, surpassed 1 trillion won in 2015, recording 1.13 trillion won in two years. In 2017, it exceeded 2 trillion won with 2,681.3 billion won, exceeded 4 trillion won in 2018, 7 trillion won in 2019, and 13 trillion won last year.

Despite the huge increase in body size, it has grown almost twice every year. In particular, it showed a remarkable growth rate of 275 times compared to 7 years ago.

|

| Bucheon Coupang Logistics Center. 200.12.9/News1 © News1 Reporter Jeong Jin-wook |

◇ Establish the Kim Bum-Seok system by granting’differential voting rights’

The payment of differential voting rights is also attracting attention. Differential voting rights are a device that gives the founder more voting rights than the common stocks held by other shareholders to check hostile M&A forces and empower decision making.

Coupang decided to give Chairman Kim this differential voting right. Coupang shares consist of Class A common stock and Class B common stock. Class B has 29 times more voting rights per week than Class A. In other words, even if you only own 1% of Coupang, you can exert 29% of influence.

All of these are owned by Chairman Kim. Currently, the share ratio is not disclosed, but after listing, even if you have a 2% stake, you can exercise the voting rights equivalent to 58% of the shareholders’ meeting at the general shareholders’ meeting.

Accordingly, it is expected that Chairman Kim will continue to boldly invest and expand employment with substantial management rights. However, if Chairman Kim sold or donated shares, the differential voting function was lost.

In the industry, it is predicted that as Chairman Kim secures differential voting rights, it will be possible to maintain influence on Coupang and make quick decisions even after listing. It is explained that even if the stake is lowered by listing, it is possible to maintain control and influence as much as possible through differential voting rights.

|

| Coupangman © News1 |

◇ 100 billion treasury stock bonus paid to’Coupang Man’

Even after listing, Chairman Kim came up with concrete plans for win-win with employees.

“We plan to approve a maximum total of $900,000 or 100 billion in stock compensation to front-line workers and non-managers,” he said. “Our employees and front-line workers (Coupangmen) are the backbone of Coupang and “The reason” said.

“We congratulate the company’s monumental milestone and take into account the hardships of frontline workers to serve our customers amid the Corona 19 crisis.”

Chairman Kim’s move can be interpreted as practicing the’protocol economy’, which has recently emerged as an alternative to the platform economy.

Earlier, Airbnb donated 9.2 million non-voting shares to the Host Endowment Fund for accommodation sharing hosts at the time of listing last year. The SEC also allowed Uber drivers and platform workers to receive up to 15% of the annual compensation. In short, Uber drivers can now get Uber stock instead of pay.

As Airbnb and Uber grow up, it’s hard to ignore the contributions of the host or Uber driver who provided their home. However, in the platform economy, they have a small share of the money Airbnb and Uber headquarters earn. It is the protocol economy that started with this problem consciousness.

‘Protocol economy’ refers to an open economy in which market participants can freely create and participate in certain rules (protocols). Blockchain technology solved the security and protocol sharing problem. Decentralization and de-monopoly are possible because there is no need to follow the rules set by the platform operator. Fairness and transparency can also be improved.

In addition, Coupang promised to create 50,000 jobs by 2025. It has already hired about 25,000 employees last year, making it the largest job creation company in Korea.

Chairman Kim said, “We are able to provide services to customers and businesses that rely on Coupang every day despite the Corona 19 crisis. We will continue to contribute to the domestic local economy by investing in good jobs to contribute to the growth of the Korean economy in the future.” Said.