The battery is a key factor in determining the competitiveness of electric vehicles. The proportion of batteries in the manufacturing cost of electric vehicles also accounts for about 40%. It is not unrelated to this that the day when Tesla of the US, which is dominating the global electric vehicle market, announces new products every year is called’Battery Day’. However, the reality is that electric vehicle batteries have not yet achieved enough performance to completely replace internal combustion engines.

Electric vehicle’game changer’ innovation war

Improvement of liquid electrolyte disadvantages such as explosion

Japan Toyota, mass production target within 1-2 years

US Quantumscape, released in 2025

Samsung SDI and LG energy solutions are behind

Hits with high nickel until commercialization

It seems like the story will change soon. Electric vehicles that are second to none compared to internal combustion locomotives are expected to emerge. An electric car that charges 100% while drinking a cup of coffee, and can run up to 800 km on a single charge. This is because the passion for developing a’dream battery’ that can dramatically improve the shortcomings of electric vehicles such as’long charging time and short driving distance’ centered on Korea, the US, and Japan is hot.

Basically, an electric vehicle battery charges and discharges lithium ions (Li-ion) between the positive (+) and negative (-). At this time, the’electrolyte’, which acts as a road through which lithium ions travel, determines the performance of the battery. The electrolyte currently used in electric vehicles is liquid. The price is low, but the limitation is that the charging time is long and the capacity is small. It depends on the capacity of the battery, but it usually takes 2 to 3 hours to 100% charge (full charge) and can run about 300 km on a single charge. In particular, since the electrolyte itself is a liquid with a low ignition point, it may explode when subjected to heat or shock. The main cause of electric vehicle fires at home and abroad is batteries.

Li-ion battery charging time long and low capacity

A way to improve such shortcomings is the’all-solid-state battery’ that turns the electrolyte into a solid. The principle is the same as the conventional lithium-ion battery, but the risk of explosion is low because the electrolyte is a solid with a higher ignition point than a liquid. In addition, the charging time is short, the performance is better, and the volume can be reduced, so it is called the’dream battery’. “It is the most advanced form of electric vehicle batteries developed so far,” said Lee Ho-geun, a professor at Daedeok University’s automobile department. “The market can change depending on who takes the lead in next-generation batteries such as all-solid-state batteries.”

Graphic = Reporter Park Chun-hwan [email protected]

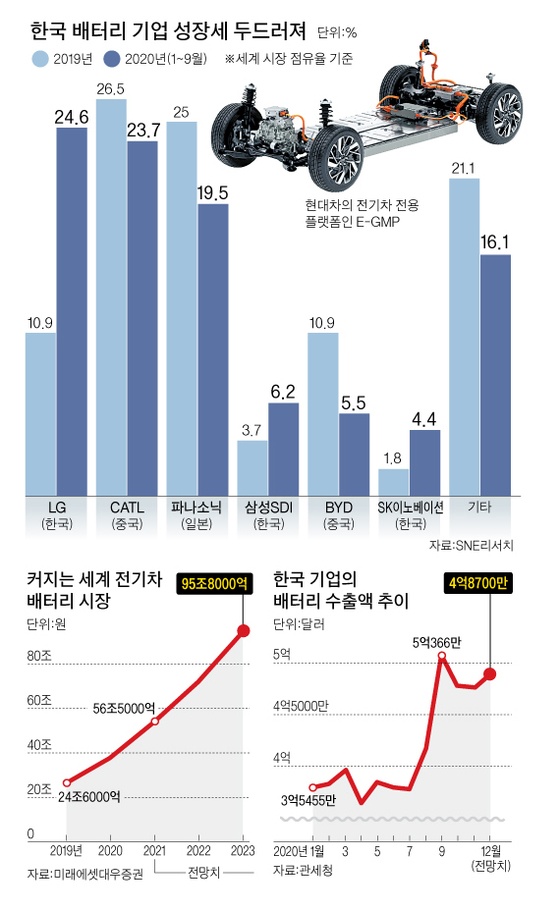

Currently, the electric vehicle battery market, which is worth about 40 trillion won, is divided into three parts: Korea, China and Japan. The next-generation battery, a’game changer’, can completely change the current market game. For this reason, not only Korea, China, and Japan, which are the powerhouses of existing automobile batteries, but also battery and finished car makers in the US and Germany are focusing on the development of solid-state batteries. Japan is the most advanced country for commercialization. Japan is more active in the development of all-solid-state batteries, as it hurt its pride by losing its leadership to Korea and China in lithium-ion batteries. Toyota of Japan unveiled its own all-solid-state battery on December 11th. According to Toyota, the battery can be fully charged in just 10 minutes, and can run 500 km on a single charge.

In particular, Toyota has more than 1,000 patents related to all-solid-state batteries. The industry explains that the latecomers are experiencing difficulties as Toyota is blocking the path to the development of all-solid-state batteries with patents. An official from an automaker analyzed that “Toyota seemed to be not interested in electric vehicles so far, but it has been hung up on battery development early on,” and said, “We anticipate that if we make a proper battery, we can turn the electric vehicle market at any time.” In fact, Toyota aims to unveil the world’s first electric vehicle equipped with an all-solid battery this year, and mass-produce it within one to two years.

The United States, which has had a small presence in the field of electric vehicle batteries, is also in the process of completing solid-state batteries. Quantumscape, an electric vehicle battery startup, announced on December 8 that the all-solid-state battery under development has reached a level that can charge 80% in 15 minutes. It can run about 300 miles (483 km) on a single charge and has a lifespan of 12 years. Quantumscape is a company invested by Microsoft founder Bill Gates and Volkswagen, Germany. Volkswagen plans to introduce electric vehicles with all-solid-state batteries from Kwon Termscape in 2025. Jagdeep Singh, CEO of Quantumscape, said, “If we succeed in developing all-solid-state batteries, Tesla will also want to use our products.” Solid Power in the US, invested by Samsung and Hyundai Motors, is also planning to commercialize all-solid-state batteries by 2026.

54% of all solid battery patents in Japan

Compared to Japan and the United States, the commercialization of all-solid-state batteries by domestic companies is somewhat lagging behind. In May of last year, Samsung SDI unveiled the research results of an all-solid-state battery capable of driving 800 km on a single charge. Based on this research, Samsung SDI plans to mass-produce all-solid-state batteries by 2027. LG Energy Solutions also announced in last year’s earnings conference call that it will commercialize all-solid-state batteries in 2028-2030.

This difference between major battery-related companies in Korea, the United States, and Japan can be confirmed in related patents. According to the European Patent Office (EPO) and the International Energy Agency (IEA), among international patents for all-solid-state batteries, Japan accounts for 54%, the US 18%, and Korea 12%.

However, this does not mean that’K-Battery’, which has become a new export product in Korea, is losing its competitiveness. There are still many mountains to overcome until the commercialization of all-solid-state batteries, and even if it goes as planned, there are 2-3 years left. In the transitional transition to solid state, batteries that can replace existing lithium-ion are not adequate, but K-batteries are evaluated to be one step ahead in this field. Representative examples are the’nickel, cobalt, manganese, aluminum (NCMA) battery’ that LG Energy Solutions will commercialize for the first time in the world in the first half of this year, and the’nickel-cobalt-aluminum (NCA) battery’ of Samsung SDI.

NCMA·NCA is a’high nickel’ battery with a higher nickel content, and its mileage is increased by more than 100km compared to existing batteries. It is predicted that it will become a major trend in the electric vehicle battery market until the all-solid-state battery is commercialized by improving stability. In fact, Hyundai Motor Company, GM and Tesla of the US are planning to introduce electric vehicles equipped with high-nickel batteries this year. “This year, especially, the demand for high-performance, mid- to large-sized electric vehicle batteries is expected to increase significantly,” said Wonseok Won-seok, a researcher at Hi Investment & Securities, predicting that demand for high-nickel batteries with improved performance and stability will increase.

New electric vehicles such as Hyundai Ioniq 5 and Mercedes EQA

I think I will see more electric cars on the road this year. The world’s major automakers declare this year as the’first year of electric vehicles’ and are preparing to launch various new cars. Based on the electric vehicle platform’E-GMP’ that was unveiled at the end of last year, Hyundai-Kia Motors plans to introduce’Ioniq 5′,’CV’ (project name), and Genesis’JW’ (project name) this year. E-GMP electric vehicles can drive more than 500km in domestic standards with a single charge, and can drive 100km with only 5 minutes charging.

In addition, it can be charged up to 80% in 18 minutes using an ultra-fast charger. GM Korea also plans to release about six new cars this year, of which two are electric cars.

One is a partially modified model of the’Volt EV’, and the other is a new electric vehicle of the SUV type. Ssangyong Motors is also planning to introduce a Koran-class electric car called the project name’E100′.

Mercedes-Benz Korea officially launched’The New EQC’ last year, and is planning to introduce’EQA’ and’EQS’ this year. BMW Korea is also releasing the iX and X3-based electric car’iX3′. Audi Volkswagen Korea is planning to introduce four electric cars such as the’e-tron Sportback 55′ and’ID.4′ of the coupe type this year alone. The e-tron, a high-performance electric vehicle, is known to be able to charge up to 80% in 30 minutes.

Analytical organizations at home and abroad predict that the electric vehicle market will grow rapidly from this year to 2030. According to market research firm MarkLines, global electric vehicle sales in October of last year increased by 125% compared to the same period of the previous year to 329,000 units, a record high. Despite the negative growth of the total car sales by about 5% due to the corona 19 re-proliferation tax and seasonal factors, electric car sales were on a high streak.

According to SNE Research, global electric vehicle sales are expected to reach 6878,000 units this year. This is a 43.3% increase from last year’s sales estimate (4.8 million units). SNE Research predicts that the global electric vehicle market will grow at an annual average of 21% and grow to 40 million units in 2030. Morgan Stanley also predicted that sales of electric vehicles this year will increase by 50% from last year, and sales of internal combustion locomotives will increase by only 2-5%.

SNE Research predicted, “In the Korean market, competition in the auto industry is expected to become more intense as the government announced an extension of the individual consumption tax cut for automobiles until June.” The government previously decided to keep the existing opening tax cut rate at 30% and establish a new limit of 1 million won.

Reporter Hwang Jung-il [email protected]