As of the end of 2019, 67% of the founder majors of 36,500 domestic venture companies were engineering (engineers). Management and economics accounted for only 17.6%. In addition, the total sales of these venture companies reached 193 trillion won and the number of workers reached 84,000.

On the 30th, the Ministry of SMEs and Startups (Ministry of Small and Medium Business) announced the results of the ‘2020 Venture Business Precision Survey’ based on the above. As of the end of 2019, the survey was conducted online (online, telephone, fax, and email) for three months from August to October.

As of the end of 2019, we analyzed the management performance, employment, technology development (R&D) investment status, and industrial property rights of 36503 venture companies (excluding preliminary ventures, closures and closures).

According to data, as of the end of 2019, the total number of employees in venture companies was 804,000, reaching an average of 22.0 people per company. It increased by 15.8% compared to the previous year.

Engineering (engineer) was the largest with 67.1%, followed by business and economics (17.6%), natural sciences (6.4%), and humanities and sociology (5.9%). 48.0% of the CEO was also engineering (engineer).

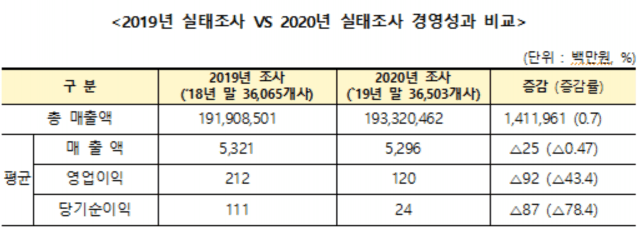

As of the end of 2019, the total sales of venture-confirmed companies is about 19.33 trillion won. Compared to large companies, it is next to Samsung Electronics.

In addition, venture companies created 117,000 new jobs in one year in 2019. During the same period, it is 5.6 times that of the 4 major groups (21,000 employees). The proportion of regular workers in venture companies increased 3.1%p (96.0 → 99.1%) from the previous year, and non-regular workers averaged 0.2 per company, down from 0.8 in 2018.

As of the end of 2019, B2B has the highest sales composition ratio of 75.4%, B2G 14.3%, overseas sales 6.0%, and B2C 4.3%. The ratio of R&D expenses to sales was significantly higher than that of other companies. However, the amount of R&D (18 years: 325.4 → 19 years 282 million won) and R&D ratio (5.5 → 4.9%) decreased from the previous year. Facility investment amounted to 210 million won, an increase of 71.1% from the previous year (18: 122.7 → 19: 210 million, +87.3 million).

Related Articles

Selected as 9 specialized evaluation agencies for venture business certification

IBK-Ministry of Small and Medium Businesses, held the’Small and Medium Business Regulatory Innovation Grand Prize’

IBK,’Small and Medium Venture Business Financial Support Award’ Presidential Citation

5G service, speed is SKT, coverage is LGU + multi-facility is KT

In 2019 alone, domestic industrial property rights owned by venture companies amounted to 273,725 cases, which accounted for 53.6% of the total domestic industrial property rights. In particular, 20.9% of respondents said their technology level was the world’s best or equivalent. As for the equity structure, the founder’s share was the largest with 64.2%, with 13.1% for employees, 11.6% for investors, and 11.1% for families. As for the management difficulties, the most difficult matters in managing funds such as financing and management were.

“As a result of this fact-finding survey, venture companies have once again confirmed that they are the leading economic players in Korea in various aspects such as creation of new jobs, job stability, and sales, and they are leading innovative growth through continuous research and development,” said ” In particular, in February next year, a new private-led venture confirmation system will be implemented, and a private venture confirmation institution will select venture companies with technological innovation and market growth potential.”